Key takeaways:

Watch the video below to get an overview payroll processing timelines in under 5 minutes, then browse our Payroll Software Guide to find ways to make your payroll processes more efficient.

What is payroll processing?

Payroll processing refers to the time between the end of the pay period and payday. During this timeframe, employers will examine the entire pay period and perform tasks necessary to ensure employees are paid by the next payday. These tasks typically include the following:

- Calculating employee wages, including overtime, premium payments, shift differentials, bonuses, holiday pay, or paid time off.

- Deducting benefits premiums and other company-specific items, like uniforms, from employee wages.

- Withholding and reporting applicable federal, state, and local payroll taxes or garnishments.

- Notifying appropriate government agencies of new hires.

- Applying status changes, such as raises, promotions, or missing hours.

- Producing paychecks for employees via appropriate payment methods.

Employers can also tie company-specific items to payroll processing periods, such as paid time off requests. However, employers must complete all these processes with enough time for employees to receive their money by the company’s designated payday.

How long does payroll take to process?

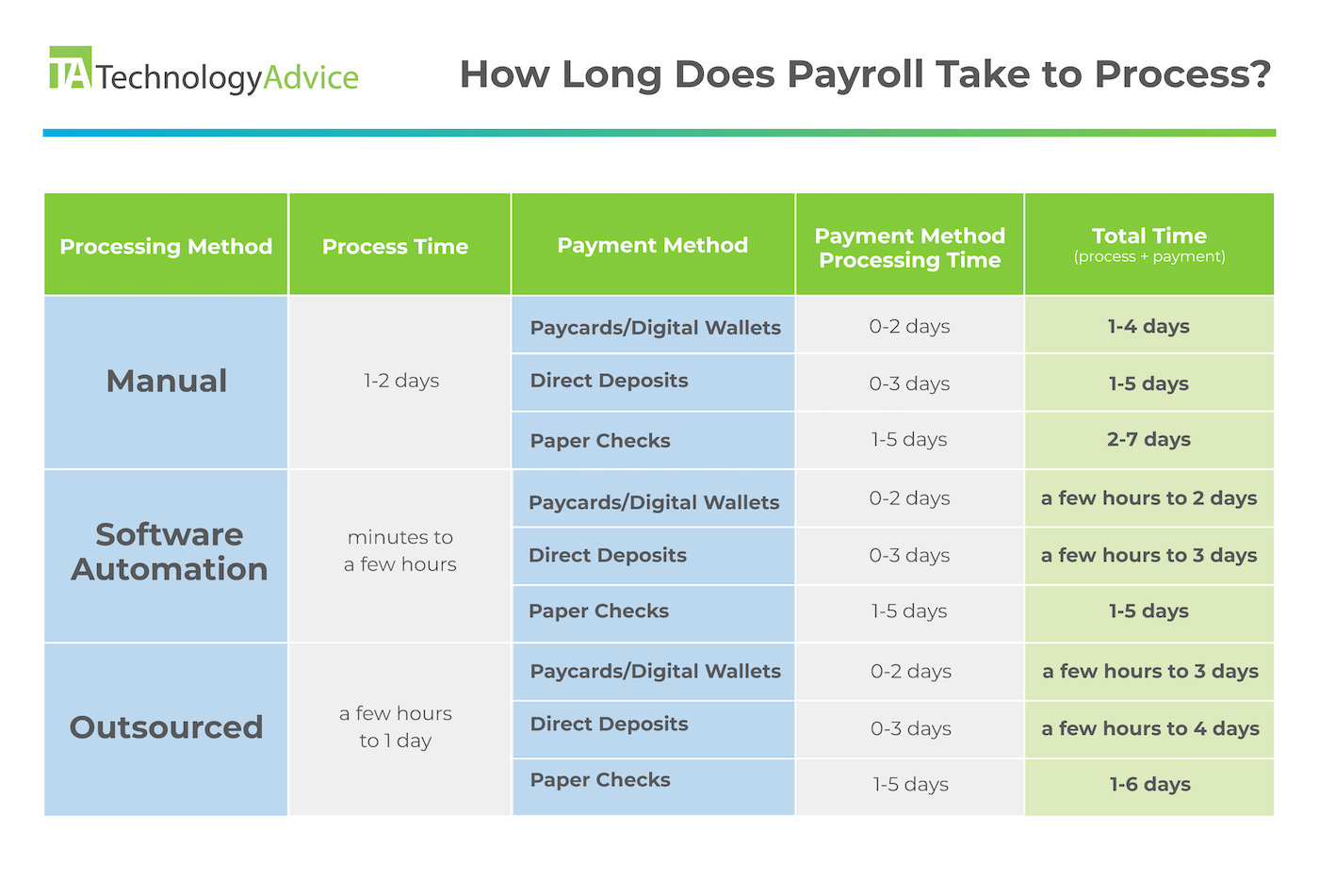

In a perfect world, the total time it takes to process payroll depends solely on the processing method and payment method processing times. Between the two, it takes an average of 5 days to process payroll in the U.S.

Companies can determine their total payroll processing times using the chart below. Companies can also see the additional time it takes employees to receive funds into their bank accounts through various payment methods.

What factors affect payroll processing time?

Several factors can affect how long it takes to process payroll, including processing methods, pay schedules, pay structure difficulty, compliance matters, and workforce type.

Processing methods

How companies process their payroll is the payroll processing method. Although there are several methods, below are the three most common.

Manual

Manual payroll processing involves calculating payroll without the help of outside human resources (HR) experts, accountants, or payroll or accounting software. This method takes the longest, even with spreadsheet software like Microsoft Excel or Google Sheets, because payroll processors must enter payroll changes manually. As a result, the more employees a company has, the longer it takes to process payroll.

Software automation

Software automation is the quickest way to process payroll, as payroll, accounting, and time tracking software will automatically calculate most of the payroll and sync it across as necessary record systems. Software platforms can also help companies comply with necessary payroll laws, such as federal, state, and local minimum wage and tax laws, to avoid manual research and implementation. Moreover, when companies add employees, very little time is added to payroll processing since most software can handle these changes instantaneously.

Outsourcing

With outsourcing, companies hand off processing payroll to an outside payroll service for handling. Outsourced payroll providers usually have advanced software for managing multiple clients’ payrolls, so this method is faster than manual payroll processing. However, because companies must provide necessary payroll changes and updates to their payroll provider, the back-and-forth communication can make the process slower than in-house payroll processing with software automation.

Pay schedules

Pay schedules can influence how much time companies have between the end of a pay period and a payday to process payroll since most, but not all, employers pay employees in arrears. Paying employees in arrears means employees receive funds for the work they performed in a previous pay period during the current one.

The examples in the chart below illustrate how long a company has to process payroll based on the selected payroll schedule, pay period, and payday.

| Payroll schedule | Pay period | Payday | Max number of business days to process payroll (not including payday) |

| Weekly | Sundays-Saturdays | Fridays | 4 days |

| Biweekly | Week 1 Sunday–Week 2 Saturday | Every other Friday | 9 days |

| Semi-monthly | 1st–15th of the month & 16th–last day of the month | 15th of the month & the last day of the month | 11 days |

| Monthly | 1st–last day of the month | 1st of the month | 26 days |

Although the chart provides examples of the payroll processing times for different pay schedules, they are not universal. For example, some companies may not pay their employees in arrears, while others define their weekly, biweekly, semi-monthly, or monthly pay periods and paydays differently.

Most importantly, however, companies should check their state and local laws, as many jurisdictions regulate how long employers can wait to pay employees after they performed the work.

Payroll difficulty

Payroll complexity can add to a company’s overall payroll processing time. For instance, the scenarios below can easily delay completing payroll on time.

- Collecting and inputting timesheet data.

- Computing various pay rates, including overtime, shift differentials, premium pay, retro pay, or bonuses.

- Calculating holiday or other paid time off.

- Paying multiple worker types, including salary and hourly employees and contingent workers.

- Running multiple payment methods, such as paper checks and direct deposits.

- Adding in multiple new hire data.

Even if companies use software automation to run their payroll, failing to add necessary data regularly could force payroll processors to spend significant time on data entry and further extend payroll processing times.

Federal, state, and local laws

Federal laws, such as the Fair Labor Standards Act (FLSA), enforce overtime and minimum wage. In addition, several states have more stringent overtime and minimum wage laws, as well as laws governing sick leave pay, termination check procedures, and paycheck frequencies.

Companies must also be mindful of federal, state, and local tax regulations and laws governing payroll deductions, pension contributions, insurance, garnishment procedures, and new hire reporting. International employers, too, must reconcile not only differing tax laws but labor laws, customs, and currencies — all of which can add time to finalizing payroll.

Workforce type

Exempt versus non-exempt from overtime, full-time versus part-time employees, regular employees versus independent contractors — managing multiple worker classifications can add significant time to finalizing payroll. Each worker group comes with its own set of labor laws and tax regulations, benefits eligibilities, and pay structures.

International employees and contractors also have their own set of payroll processing challenges. For instance, companies relying on certain global payroll providers could add several days or weeks to the payroll process compared to domestic payroll.

5 ways to speed up your payroll process

You can improve your payroll processes by developing a routine, conducting frequent payroll audits, outsourcing your payrolls, or taking advantage of time and attendance or payroll software.

1. Develop a routine

Developing a routine and preparing beforehand can shave hours off payroll processing. For example, creating and aligning the company around certain payroll procedure deadlines can prevent accounts payable teams or payroll specialists from scrabbling before payday.

For example, you can include the following schedule in your overall payroll policy to ensure all payroll elements are ready to go as soon as the pay period ends.

- Timesheets must be turned in and approved by managers by [day/time].

- Unpaid and paid time off requests must be turned in and approved by managers by [day/time].

- New hire data must be inputted by [day/time].

- Payroll status changes are due by [day/time].

- Payroll calculations must be completed by [day/time].

- Payday is on [payday frequency].

2. Conduct frequent payroll audits

Payroll audits can help uncover areas in your company’s payroll processes that are taking up time or causing unnecessary workflow bottlenecks.

For example, a payroll audit could reveal payroll stakeholders do not receive employee timesheet data or employee pay rate changes on time, causing delays in payroll finalization. Frequent payroll audits can uncover these problems early so you can adjust your strategies and expectations to reduce the time spent on these processes.

3. Consider outsourcing your payroll

You should consider outsourcing if your team is too small to handle the payroll processing workload or if your payroll is too complicated. Beyond calculating employees’ gross and net pay, outsourcing payroll can ensure your company complies with all payroll and tax laws.

Several outsourced payroll processing schemes exist. For example, you can hire an outside accountant to process just your payroll for you. However, to drastically reduce payroll risk and liability, you could partner with a PEO or EOR. Some payroll software vendors even include these services for additional fees — ADP, for instance, offers HRO and PEO services.

| Key terms | |

|

|

| What’s a PEO? A PEO (professional employer organization) is a company that partners with you to provide HR services such as payroll, benefits administration, HR consulting, and workers’ compensation. PEOs also act as a co-employer, meaning both you and the PEO share HR responsibilities and liability. |

|

| What’s an EOR? An EOR (employer of record) is a company that serves as the legal employer of your employees. It offers similar services and benefits to a PEO with greater compliance risk protection. |

|

| What’s HRO? HRO (human resource outsourcing) means a third party manages some HR tasks like payroll for you. You can also choose what tasks to outsource while managing others in-house. Unlike PEOs and EORs, you remain responsible for compliance risk and liability. |

|

4. Use time and attendance software

Time and attendance software can help you virtually eradicate one of the most tedious aspects of payroll processing: inputting employee timesheet data into payroll. Some software vendors like Gusto include time-tracking features that integrate directly with payroll functions.

Some of the ways these tools can improve payroll processing efficiency include:

- Clock-in and clock-out reminders.

- Timesheet approval notifications.

- Time-off and company holiday tracking.

- Automated sync with payroll tools.

5. Invest in payroll software

Payroll software can significantly reduce payroll processing time to just a few minutes or hours, as it automatically performs the following functions at the end of the pay period:

- Employee wage calculations.

- Compliant payroll tax withholding.

- Paid time off (PTO) tracking.

- Administrative updates based on workforce changes.

- Error notifications.

Some software vendors have moved the responsibility of processing payroll from the employer to the employee. Paycom’s Beti, for example, helps employees complete their own payroll from start to finish, almost entirely divorcing employers from the payroll process.

Check out Paycom’s Beti below:

But what payroll software is the best for your business? The guides below offer some of the best options to help you manage your payroll processes.

- If you’re on a budget: Best Free Payroll Software.

- For international payroll support: Top Global Payroll Solutions.

- For your team of contractors: Top Contractor Payroll Solutions.

Check out our Payroll Software Guide for a complete list of solutions.