Key takeaways:

- For pay and benefits purposes, federal laws classify workers based on the level of economic dependence on their employer and whether they are subject to overtime pay; state and local laws further classify workers to determine access to certain government benefits.

- Employers can further classify their workers based on their needs, such as compliance risk or company benefits eligibility.

- Properly classifying workers can help employers avoid costly labor laws violations while making sure workers receive all of their due pay and benefits.

Employee versus independent contractor. Full-time versus part-time. Exempt versus non-exempt. What is the difference? Considering up to 30% of employers have misclassified an employee in their lifetime, odds are they’ve asked themselves before and gotten it wrong.

To ensure employees receive the pay and benefits they are rightfully owed and to keep themselves out of legal trouble, employers should analyze whether they are correctly classifying their workers. Follow our guide below to identify the main types of employees, so your business remains compliant while keeping your employees happy.

What is employee classification?

Employee classification is a system of categorizing employees to determine their pay and tax circumstances. Employers could also use it to identify employees eligible for company benefits.

Beyond the scope of pay and benefits, there are additional classifications that employers need to reconcile. For example, the United States Citizenship and Immigration Services (USCIS) — the governing body responsible for the I-9 form in onboarding paperwork — requires employers to monitor employees’ authorization to work in the U.S. As a result, employers could divide their workforce into U.S. citizens and non-U.S. citizens, with further subcategories under non-citizens requiring additional legal considerations.

For organizational purposes, employers could also categorize employees into groups that satisfy particular business needs. For example, companies could subdivide workers by title, executive status, or paycheck frequency. Doing so aids companies not only in compliance matters but administrative ones as well.

What are the types of employee classifications?

Generally, U.S. federal law classifies private-sector workers based first on their economic dependence on the employer, such as the amount of control over their work schedules. Federal law further classifies employees based on whether they are subject to overtime pay.

State and local laws also affect the classification of workers for access to particular state benefits. Michigan, for example, requires employers to distinguish employees between full-time and part-time to determine eligibility for sick time benefits under the Paid Medical Leave Act.

Beyond that, employers can adopt a classification strategy that addresses the level of compliance risk they want over their workers, benefits, and company productivity. However, once they outline their classification strategy, companies must enforce it consistently throughout their organization.

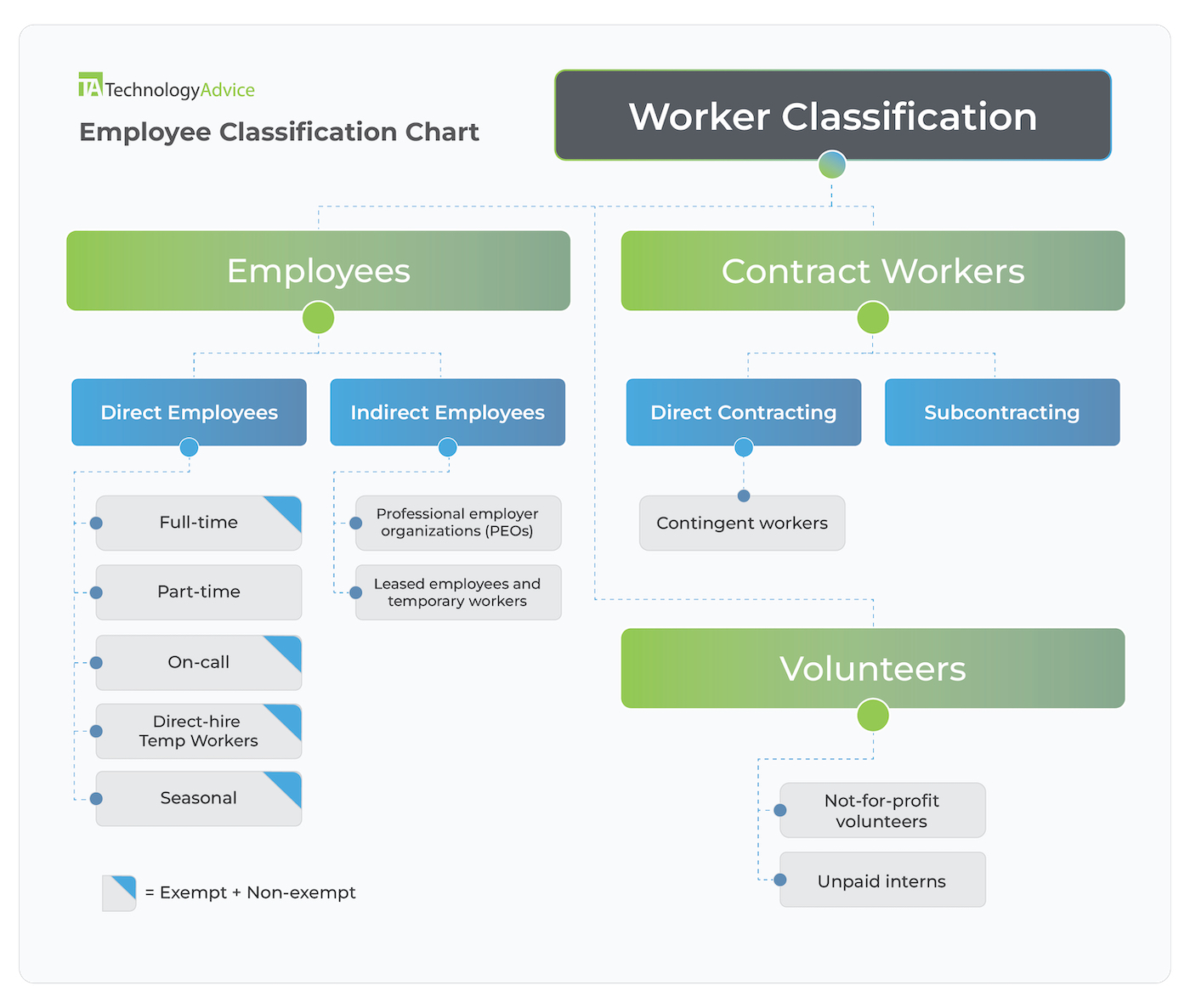

The chart below represents the most common employee categories for pay and benefits purposes:

Employees

In the U.S., employees are workers who are economically dependent on their employer for things like pay, work schedules, equipment, and job permanency. Unlike contractors or volunteers, they are protected by federal labor laws, including the Fair Labor Standards Act (FLSA), the Family Medical Leave Act (FMLA), and other employment-based state and local labor laws.

Employees represent a considerable portion of the workforce and require the most oversight by employers. Employers can further subdivide employees by the level of compliance risk they want over the employee life cycle and, below that, based on access to company benefit programs and particular production requirements.

Direct employees

Direct employees, or direct hires, are employees whose pay and benefits are the responsibility of their employers. In most contexts, they are considered “traditional employees,” as their employers dictate how and when they do their jobs.

Employers are entirely responsible for direct employees’ pay, benefits, discipline, safety, and other compliance matters. Because of this, direct employment relationships make the most sense for businesses with well-established human resources (HR) departments to monitor employment law compliance, employee health and wellness, and proper employee pay and benefits administration.

However, employers have the most direct influence over these workers, with the ability to control their schedules and training and development. So, these workers easily grow with and invest in the company as needs evolve.

Exempt vs. non-exempt employees

Under the FLSA, employers must classify all direct hires as either exempt or non-exempt from overtime. While the FLSA defines overtime as any time worked over 40 hours a week, state and local laws may also have their own definitions. California, for example, defines overtime as any hours worked over 8 hours a day.

So what makes an employee exempt or non-exempt from overtime? The FLSA criteria are quite involved, but the distinction is based mainly on how employees are paid (salary or hourly) and their role in the organization.

Exempt: These employees are paid on a salary basis of at least $684 a week. They also must work in an exempt profession, such as executives or administrators. IT and other learned or creative professionals, like attorneys or graphic artists, also fall into this category.

Non-exempt: Employees paid an hourly rate and who do not work in the above roles are considered non-exempt from overtime. They are subject to both minimum wage and must be paid at a rate of one and a half times their normal hourly rate for any overtime hours worked in a week.

Paying an employee a salary does not automatically make them exempt from overtime. Likewise, developing bogus job titles to align a non-exempt employee’s job duties with that of an exempt employee sets employers up for serious labor law violations and deprives workers of their entitled overtime pay. If an employer is unsure if an employee is exempt or non-exempt, it’s better to consult a labor law expert for advice before risking FLSA fines or decreased employee confidence in the workplace.

Also read: How to Avoid These 3 Costly Payroll Mistakes

Full-time vs. part-time employees

The federal government does not regulate the terms “full-time” and “part-time” regarding employee compensation. However, it is used by the Affordable Care Act (ACA) and other state and local governments for access to specific government benefit packages or mandated sick leave laws. The ACA, for instance, states a full-time employee works an average of 30 hours per week for more than 120 days a year.

Generally, the distinction between full-time and part-time employees is up to the employer to decide, often in consultation with their benefits administrator. Most employers designate full-time employees to work between 30 and 40 hours per week to be eligible for benefits like paid time off or medical insurance. Part-time employees work less than 30 or 40 hours per week, depending on how the employer defines their full-time employees; they are also typically ineligible for company benefits.

Most employers have a mix of both part- and full-time employees. Full-time employees may be more costly for the employer but are usually more loyal and knowledgeable of company practices and priorities. Meanwhile, part-time employees are great for businesses looking for individuals with a more flexible work schedule to fill personnel gaps as needed in high-turnover industries, such as retail or manufacturing.

On-call employees

These are employees who are required to work should their employers contact them. The employee could either be on the employer’s premises waiting to work or at home waiting to come into work for a specified period should the need arise.

On-call employees are necessary for businesses in unpredictable industries, such as healthcare, public safety, or maintenance, and either replace or supplement staff during moments of crisis or other unforeseen events.

Seasonal employees

Seasonal employees work for an employer for a specified period, usually during the winter or summer months. For example, workers at an amusement park in a seasonal area may only work during the spring, summer, and fall months but not during the winter when the park is closed.

Indirect employees

In contrast to direct employees, indirect employees are not paid directly by their workplace employer. Instead, these employees are paid by outside organizations, who then either co-employ or lease the employee. As a result, indirect employees are advantageous for employers looking for temporary workers or small businesses needing to outsource their payroll and mitigate compliance risk.

Professional employer organizations

Professional employer organizations are companies that engage in a contractual relationship with another company and share employer responsibilities. For instance, if ABC Corp and a PEO shared a contractual relationship, all of ABC Corp’s employees are also the PEO’s employees.

PEOs run payroll, administer benefits and workers’ compensation insurance, and provide HR support for their clients’ employees. Small and midsize businesses can benefit from the co-employment relationship, as it eases the administrative burden off of their smaller staff while reducing the costs and liability associated with a full employer.

Leased or temporary employees

Leased or temporary employees are workers who are contracted with a staffing agency but work for another employer. Employers use these workers when staffing needs require additional help for projects for a specific period.

They are an excellent alternative to part-time, seasonal, or independent contractor work, as most of the administrative and regulatory tasks associated with leased employees remain in the purview of the staffing agency, not the employer.

Contract workers

Contract workers, as opposed to employees, are workers who have the most flexibility in their work and schedules. These workers either work for themselves or provide work within a limited timeframe or until they complete an assigned project.

Contract workers can be subdivided between direct contracting and subcontracting depending on the number of parties involved in obtaining the contract worker.

Direct contracting vs. subcontracting

The main difference between direct contracting and subcontracting employment types is the degree of separation between the employer and the worker.

Direct contracting involves a relationship between the organization and the worker. Subcontracting, on the other hand, consists of a relationship between the employer, the worker, and a third party. Organizations pay the third party or vendor for the worker’s labor in a subcontracting relationship.

A direct contracting relationship means employers have contingent workers on their payroll. Outside of traditional employees, these workers are the second most common employee classification but often the most misclassified.

Contingent workers

Contingent workers are the most independent of all employee classifications. They include independent contractors, freelancers, gig workers, and consultants. Although employers directly hire these workers, they are not eligible for employer benefits or traditional employee tax advantages. This can be enticing for employers with limited budgets, as contingent workers are an effective way to keep labor costs low.

However, employers must make sure these workers are contingent under the FLSA before classifying them as such to avoid significant penalties. For example, employers must pay back taxes plus additional penalties from the IRS and the U.S. Department of Labor (DOL) for each employee misclassified as a contingent worker.

Misclassifying workers also places workers at a financial disadvantage. A typical construction worker, for example, loses out on as much as $16,729 a year in income and job benefits through classification as an independent contractor, according to the Economic Policy Institute.

Nevertheless, contingent workers can provide for projects requiring higher staffing levels or specialized knowledge traditional employees lack. Moreover, offering contingent employment opportunities may help attract incoming Generation Z workers who value autonomy and flexibility in the workplace.

Volunteers

Volunteers donate their time to public or nonprofit organizations for public service, religious, or humanitarian goals. Volunteer schedules are flexible, and the employer does not pay them; instead, they receive either charitable or educational experience.

Unpaid interns or trainees also fall under the volunteer category. The FLSA has strict guidelines on the intern-employer relationship, but generally, interns receive academic credit for their unpaid time at a company.

Employers can leverage volunteer work in specific industries as a cost-saving measure; however, they should not replace the knowledge or experience full-time employees can offer an organization. Similarly, paying interns instead of offering academic credit is often a better way to motivate these employees to learn and make a more meaningful contribution to company priorities.

How can HR software help with employee classification?

As laws revolving around the classification of employees change, a tactical solution helping employers remain compliant is both a time and cost saver. For example, small teams can avoid recruiting additional HR support or consulting legal experts. In addition, software solutions can help automate payroll taxes and benefits while implementing unique strategies to address the concerns of multiple employee types side-by-side.

Automate payroll and benefits administration

Depending on how the employee is classified, requirements for payroll and benefits differ. Leveraging payroll software or other top human resources information systems (HRIS) can streamline payroll processes for employees in disparate classifications.

Gusto, for instance, allows employers to juggle payroll for employees and contractors from the same place. Namely, on the other hand, automatically keeps track of benefit eligibility for qualifying employees and allows them to complete the benefit enrollment online. As a result, employers can guarantee employees receive their pay and benefits accurately and timely without resorting to manual tracking methods.

Compliance safeguards

It can be difficult for employers with vast multi-state or multinational workforces to keep track of varying and sometimes competing regulations on employee classifications, even with the most dedicated HR department. However, many solutions have prebuilt compliance safeguards to notify companies of potential labor law infractions, so companies can resolve violations before they become serious.

Rippling’s Compliance 360, for example, monitors the number of independent contractors on payroll and notifies companies when they should change them to employees according to the laws in their work areas. Scaling companies can rest assured knowing their talent force is properly categorized while focusing their energies on higher-priority matters.

Time tracking tools

Both labor laws and company insurance carriers require employers to track employee hours for overtime and other benefits eligibility. By investing in a payroll or benefits solution that integrates with current time tracking software or includes native time tracking features, companies can consolidate payroll and benefits administration in one place.

For instance, QuickBooks’ time tracking software reminds non-exempt employees to clock in and out to ensure accurate numbers. In addition, employers can easily monitor employee hours and adjust employee categorization should their hours fluctuate.

Worker management

Worker and employer relationships change constantly; good HR software accommodates this with little effort. Deel, for example, centralizes both the employee and independent contractor experiences by offering unified pay and benefits for both. Therefore, should a worker’s situation change — such as moving from a full-time employee to an occasional company freelancer — the software documents the change while providing a consistent experience for the worker.

Why is classifying employees correctly important?

Employee classification laws are constantly evolving to accurately reflect the changing nature of work. The difference between independent contractors and employees has always been complex, even more so now with the rise of remote work.

Employers must be diligent in identifying the most accurate classification for each of their employees. Indeed, classifying or reclassifying employees is time-consuming, but the process helps avoid costly labor laws violations while ensuring workers receive all of their due pay and benefits.

Moreover, as companies grow into international markets or hire remote talent, proper worker classification can help organize and optimize a company’s workflow in an increasingly complex workforce. Many businesses need a mix of employees, consultants, temporary workers, and freelancers to remain competitive and attract employees who demand more flexible working conditions in today’s market. Understanding how employees are classified is the first step toward hiring a more diverse workforce to address the changing needs of both businesses and workers.

Misclassifying an employee can put a company in legal hot water, but a tactical software solution can help. Browse our HR Software Guide for proactive solutions to accurately identify and pay your workers.