Key takeaways

What is global compensation?

Global compensation refers to the strategic compensation given to an international workforce—employees who work in their home country and those located abroad, either on permanent or temporary international assignments. In this context, compensation includes direct payments made to employees (like salaries and bonuses) and indirect compensation, such as health insurance and paid time off.

Your global compensation strategy serves as your foundation for deciding how to pay and reward employees. With it, you can adopt equitable compensation rules for all employees that meet or exceed industry and country standards. For example, a market-based strategy allows you to pay employees at the median or midpoint of local salary data for specific job roles within the same industry.

Elements of a global compensation strategy

There are five main elements to consider when it comes to strategizing compensation for international employees:

- Base pay.

- Variable and incentive compensation.

- Premiums and allowances.

- Benefits.

- Training.

Base pay

There are four main approaches to calculating base pay:

- Home country approach: Employees are paid a wage equivalent to what they would be making in their home country. This is often used for temporary expatriates to ensure employees do not suffer financially if they are assigned to work in a country with a much lower cost of living.

- Host country approach: Compensation is based on local or national rates and the cost of living. This approach is often used for permanent relocations and hiring local employees who already reside in the country.

- Headquarters approach: Employees are paid as if they are working in the country where the business is headquartered, regardless of their actual location. Note that many countries mandate a minimum wage, so you need to make sure to abide by all local laws when using this method.

- Balance sheet approach: This method starts with a home country approach and adds allowances, deductions, and reimbursements to ensure employees receive equitable compensation as well as all necessary international benefits.

Variable and incentive compensation

Variable pay, sometimes called incentive pay, refers to compensation that is linked to performance and/or employee tenure. This type of compensation covers bonuses, stock options, and restricted share grants.

Premiums and allowances

Premiums and allowances are added to the base salary. These additional payments allow employees to maintain their standard of living wherever they’re located and cover costs associated with international moves. Examples of common premiums and allowances include hardship and hazard pay, cost of living adjustments, educational assistance, housing assistance, and home leave.

Benefits

Employee benefits consist of any perks or compensation besides base salary and other monetary payments. Some of the most common international benefits include paid time off, health insurance, retirement savings plans, and visa assistance for temporary expatriates.

Each country has different laws that dictate what benefits must be provided to employees residing within national borders, and some make specific exceptions for foreign nationals. For example, in Singapore, foreign nationals are not entitled to the country’s free public healthcare system. Health insurance is only provided to those with a valid work permit for migrant employees or an S Pass for skilled workers.

Training

While not as popular as the other elements listed here, some companies compensate international employees with cross-cultural training and language lessons to ease the transition to a new country. They may also offer assistance with repatriation or reassignment after the international posting ends.

Related: Cultivating Cultural Competence in the Workplace

How to create a global compensation strategy

Whether your business is embarking on an international expansion or the time has come to revise an established strategy, following the steps below will set you up for success.

Step 1: Establish goals

When creating or revising a global compensation strategy, you need to identify your primary goals, as these can guide your decisions throughout the process. Your company’s culture and values also play an important role, as well as your overall business objectives.

For example, your global compensation strategy could include a wide range of employee bonuses to reward performance and motivate employees. Or, your compensation strategy could focus on competitive salary packages with wellness benefits that promote work-life balance.

Step 2: Identify your competitive edge

Assess whether you have something unique to offer and highlight those advantages in your compensation strategy. These can be above-standard benefits, incentives, salaries, and perks that differentiate your company from others.

For example, say one country’s labor laws require that employees receive 13 months of pay in one calendar year, but your company offers 15 months. You can use that as a competitive edge to attract new hires, reduce high turnover or attrition, and retain potential job hoppers.

Another example is highlighting your office space, especially if it has well-stocked pantry areas and rooms where employees can rest or play games during break times. Unique perks like gym memberships, travel-related rewards, and stock options can also set you apart from competitors.

Step 3: Research legal and cultural considerations

The next step is familiarizing yourself with local labor laws and customs that will influence your compensation package decisions. Besides the required minimum wage and benefits, you’ll also need to reconcile how your compensation packages for employees in one country remain fair and equitable with those in another.

For example, the UK mandates universal healthcare and paid leave for employees, while the U.S. does not. Your global compensation strategy should consider this and find options to ensure your U.S. employees receive equitable pay and benefit options that reflect those for your employees in the UK.

You should also consider cultural sensitivities and the needs of your international workers. This is where your diversity, equity, and inclusion (DEI) policies come into play. For instance, employees in Japan may appreciate commuter benefits since many depend on public transport to get to work — while employees in Belgium would rather receive meal vouchers to lower food costs.

Step 4: Conduct competitor analysis

Whether you are putting together an international or domestic compensation package, you’ll want to research the direct compensation that your competitors in that country are offering. You can partner with salary survey providers, such as Mercer and Willis Towers Watson, to get the market and competitor data you need. Don’t forget to check if your benefits (like paid time off, health insurance coverage, or retirement plan) are on par or better than your competitors in all the countries where you are hiring.

Step 5: Create a budget

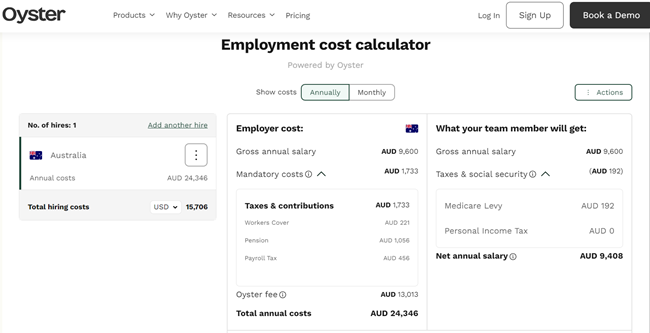

Next, it’s time to set your total compensation budget. Be sure to account for base pay, mandatory and voluntary benefits, and bonuses, plus currency exchange rates and administration costs. Use this budget to determine what benefits you can offer to employees, including the tools you need to support international hiring efforts. These expenses might include extra payroll software fees and staffing costs for additional in-house HR employees. Some global payroll providers, like Oyster, even offer free online calculators for computing employee costs.

Step 6: Categorize employees by job roles

Employees may receive different compensation packages depending on their work experience, tenure, and position. Conducting job complexity analysis and market salary research for similar positions can help determine fair compensation plans that are based on each job role and not solely on the worker’s contributions. You can even create a compensation structure with salary bands or pay grades, which you can use to identify pay increases for employees and salary offers for new hires.

Step 7: Consider partnering with on-site experts

Paying employees in other countries can be challenging, especially in staying on top of local labor laws and tax regulations. In some cases, it may be more practical to partner with an employer of record (EOR) to take care of managing essential HR tasks.

EORs provide HR support to companies with global workforce expansion plans. Oftentimes, they serve as local business entities in the countries where you want to hire people. They’ll take care of payroll, benefits administration, and compliance, while you handle all of the other workforce management needs. EORs can also advise you of changes in country labor regulations that will impact benefits and salaries, allowing you to look at your compensation package and come up with strategies to address potential gaps.

Expert Tip

Working with an EOR can get expensive, especially if you have a big team. Most EORs, like Multiplier and Papaya Global, charge around $400 to more than $600 per employee monthly. This is why some companies opt to process international payroll and manage employee benefits plans on their own.

That said, an EOR can be a better option to start with since it takes on the compliance liabilities associated with hiring and paying employees in different countries. Many EOR partners also integrate with your HRIS to simplify your distributed workforce management.

Step 8: Execute and review the strategy

After designing and implementing your global compensation strategy, review it regularly and revise it as you prepare your annual budget. You should also update your compensation strategy if there are major changes in the company, such as a business expansion or reorganization.

Use EOR services and payroll software to support your global compensation strategy

Establishing a global compensation strategy and paying international employees can be an ambitious task without well-defined processes in place. Thankfully, the right software tools and EOR services can make things easier for your HR and finance teams.

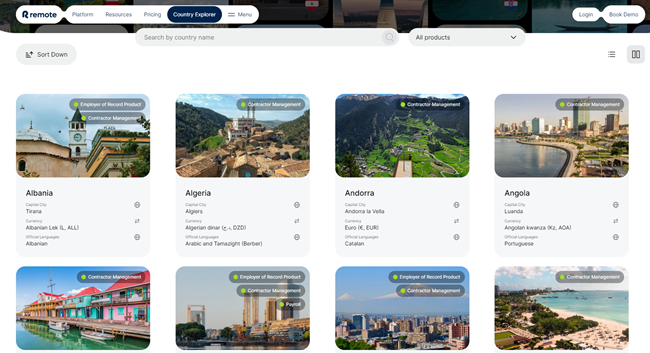

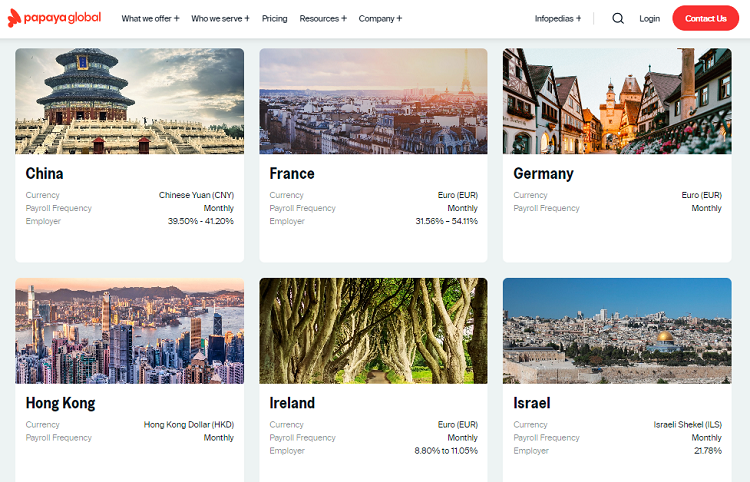

For example, providers like Remote and Papaya Global grant you access to a wide range of country guides with insightful information about pay, benefits, and other local labor regulations. These resources can help you create a competitive compensation strategy or improve your current total rewards package.

For more options, check out our lists of top global payroll software and best EOR services to find the right one for your business.