A payment gateway allows businesses to securely accept payments online or in person. Payment gateways are typically also payment processors, and they offer free or affordable payment gateway solutions with merchant accounts.

The best payment gateway offers competitive transaction processing fees, plenty of integrations for scaling, and fraud detection tools. I evaluated dozens of providers and came up with the best and most competitive payment gateways depending on your business’ needs.

What is a payment gateway?

A payment gateway is a customer-facing platform that securely collects payment information during checkout. It acts as a bridge that securely transmits payment data between the customer, the business, and the payment processor, permitting the exchange of data required for processing payments.

Payment gateways follow strict security standards and encryption protocols, like the Payment Card Industry Data Security Standard (PCI DSS).

How does a payment gateway work?

A payment gateway’s primary responsibility is to securely transmit data—collect, verify, encrypt, and relay to the payment processor. There are many steps in this process, which we outline below, but all of these are automated and take only a few seconds.

- Purchase or sale: Customer fills in their payment details at checkout.

- Data encryption and secure transfer: For card payments, data is encrypted and transmitted to card networks, while payment information for non-card transactions are sent to related networks (ACH network for ACH payments) for verification.

- Transaction forwarding: Once information is encrypted, the gateway forwards it to the payment processor.

- Authorization: The payment processor then communicates the transaction details to the card issuing company.

- Approval or denial of transaction: The card issuing bank then approves or denies the transaction based on customer’s funds and other security checks.

- Communication of transaction approval or denial: The decision is then sent back the same way from the card issuing bank to the payment processor, then to the payment gateway.

- Completion of transaction: If approved, the customer receives confirmation. If declined, the customer is notified and the transaction is stopped.

Differences between payment gateway & payment processor

A payment gateway and a payment processor play a role in accepting payments but play different roles during the transaction process. They also differ on their scope of services and integration with business systems.

| Payment Gateway | Payment Processor | |

|---|---|---|

| Role in a transaction | Secure transmission of payment data between customer, business, and payment processor | Processing and authorizing payments, securely transfer funds from consumer’s bank to business’ bank |

| Services provided | Typically no add-on services, just secure data transmission | Add-ons like fraud detection, chargeback management, payment compliance |

| Business integrations | Easier with APIs, plug-in, and modules | Complex setup procedures; merchant account required |

Best payment gateways at a glance

Providers

Our score (out of 5)

Monthly Fee

(starts at)

Processing fee structure

Account Approval

Authorize.net

4.58

$25

Interchange

Instant

2Checkout (Verifone)

4.46

$0

Flat-rate

Instant

Square

4.41

$0

Flat-rate

Instant

PayPal

4.41

$0

Flat-rate

Instant

Stripe

4.36

$0

Flat-rate or interchange (custom)

Instant

Helcim

4.23

$0

Interchange

5-7 business days

Chase Payment Solutions

4.13

$0

Flat-rate or interchange

5-7 business days

Stax

3.95

$99

Subscription (volume or tiered)

24-48 hours

Braintree

3.94

$0

Flat-rate or interchange

Instant or 1 business day

Is your business classified as high-risk? You may need to apply for a specialized high-risk merchant account and use its payment gateway solution.

Authorize.net: Best overall

Overall Score

4.58/5

Payment processing pricing

3.75/5

Contract & setup

4.58/5

Support & reliability

5/5

Features

4.75/5

User experience

5/5

User scores

4.4/5

Pros

- Multiple payment methods supported

- Advanced fraud prevention (AFDS)

- Excellent uptime rates

Cons

- Lacks native one-click payment tools

- Ecommerce only available via integration

- User interface looks outdated

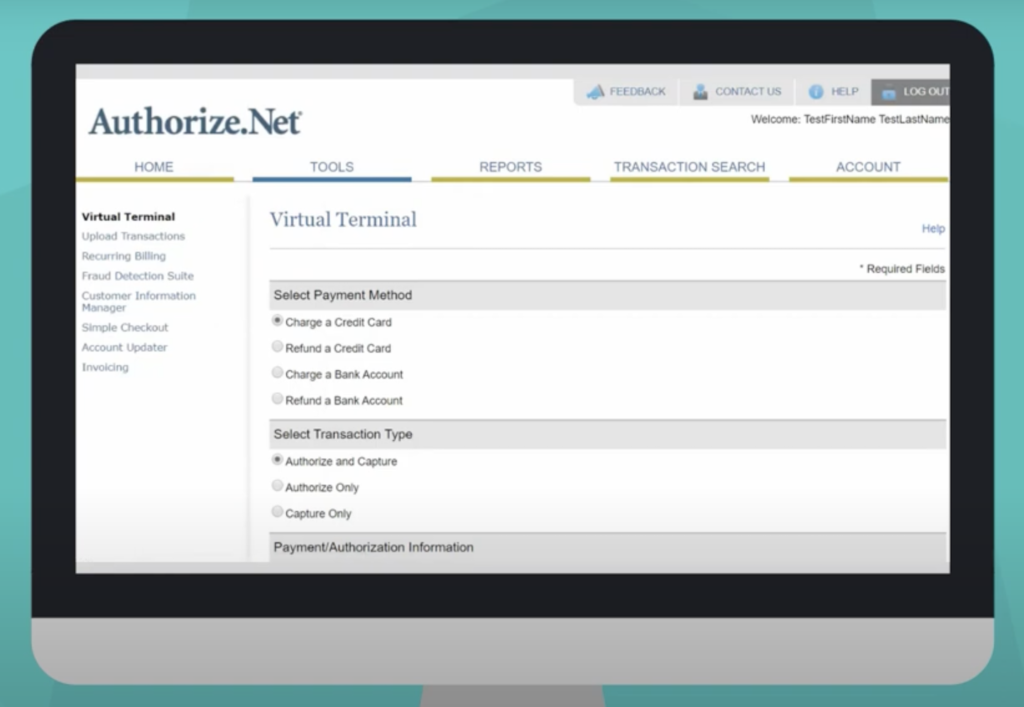

Why I chose Authorize.net

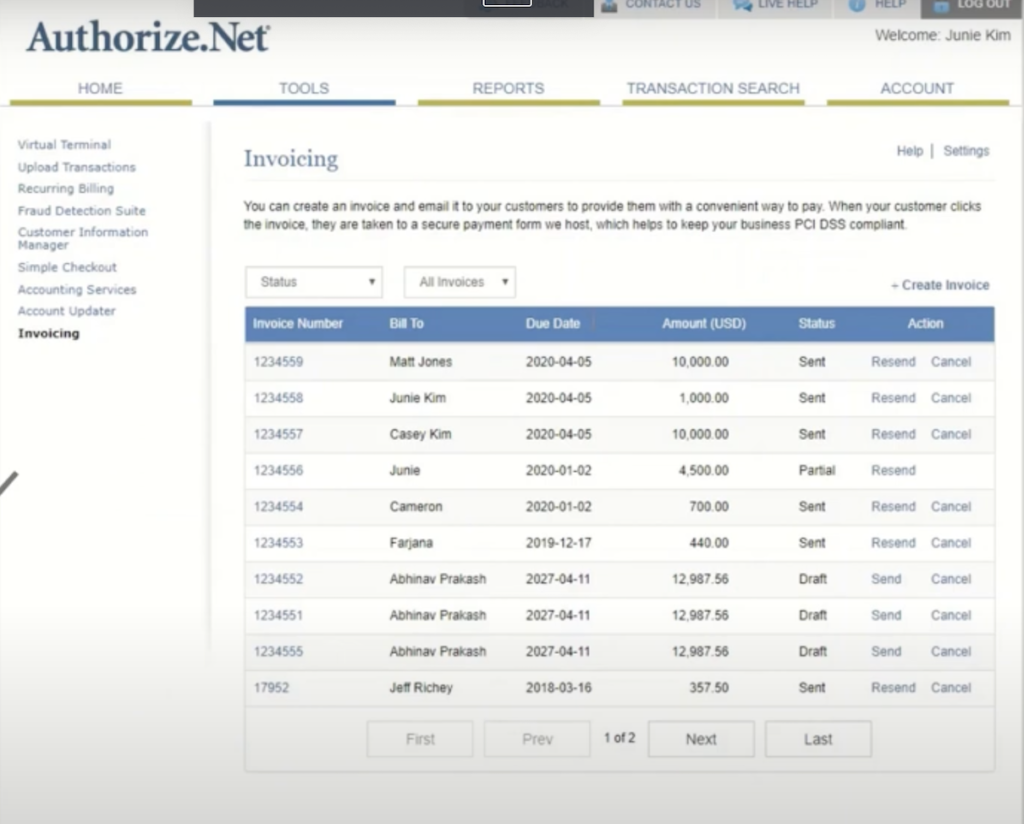

Authorize.net is one of the oldest and most trusted payment gateways. It can facilitate online, in-person, recurring, and manual payments, making it great for businesses of all types and sizes—retail, nonprofit, ecommerce, professionals, and B2Bs.

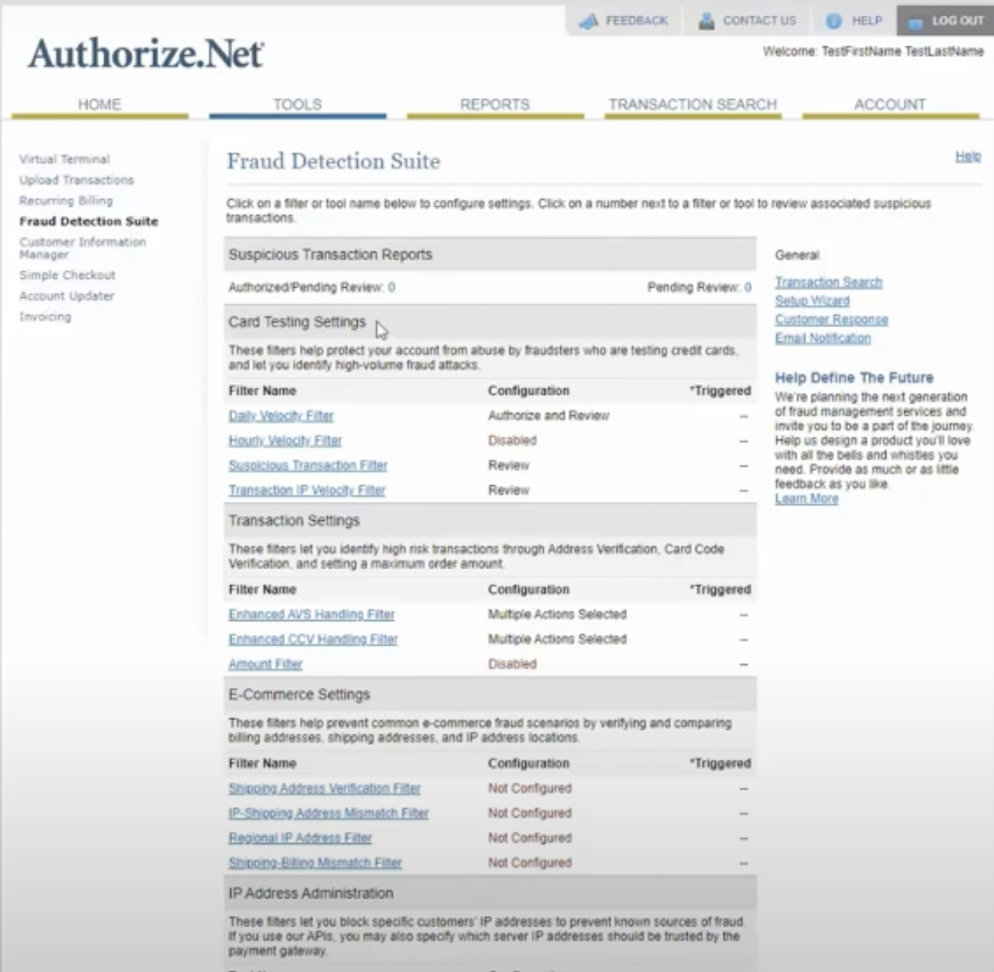

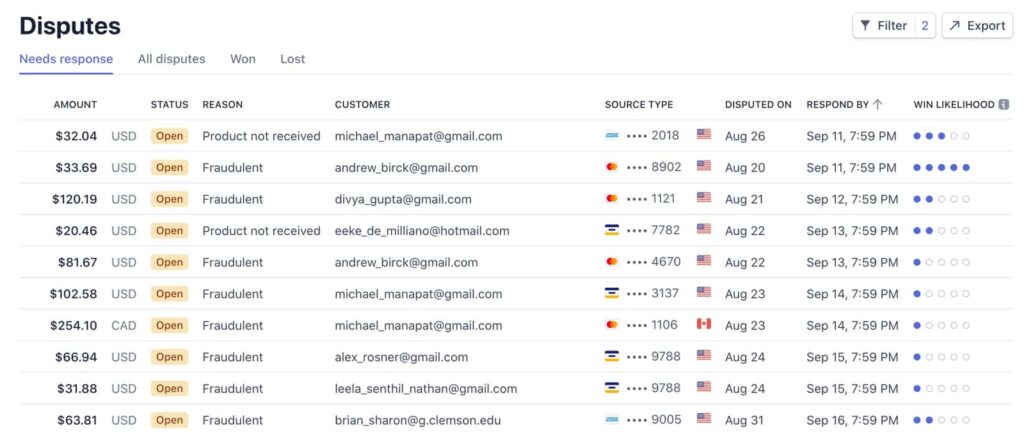

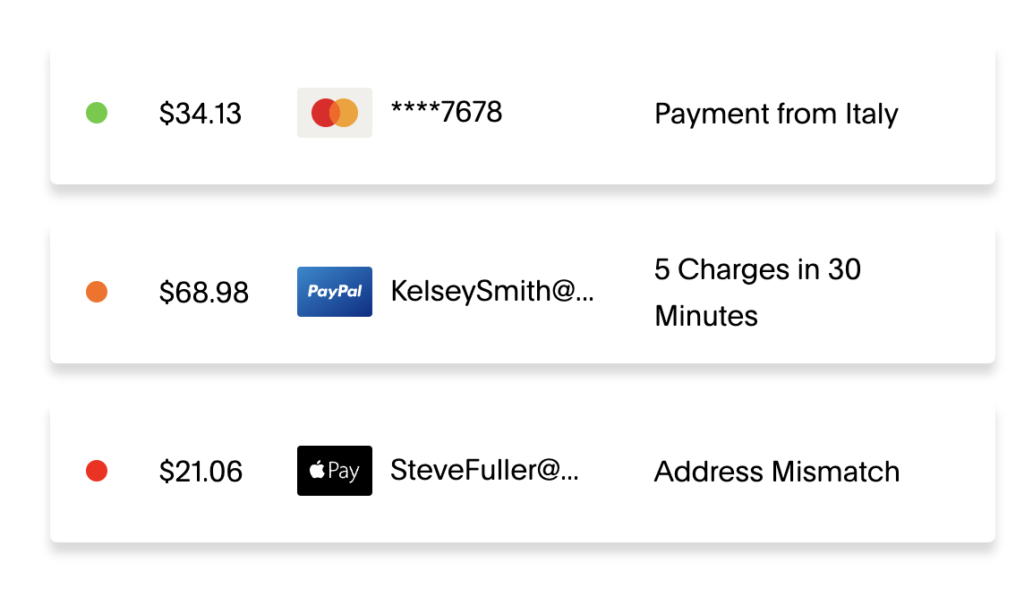

What sets Authorize.net apart from the competition is its top-notch security and anti-fraud features. Its Advanced Fraud Detection Suite (AFDS) provides 13 fraud filters that you can customize according to your business needs. For example, you can set geographic limitations, minimum transaction thresholds, payment velocity settings, and more. This feature is free and built-in, compared to other providers that feature it as a paid add-on. It is also the only gateway on this list that services high-risk merchants.

Authorize.net also lets you choose a merchant account you want to work with or get its all-in-one plan that includes a merchant account already. While it’s one of the providers on this list that come with a monthly gateway fee (such as Stax), its $25 fee is very affordable as you get lower processing fees.

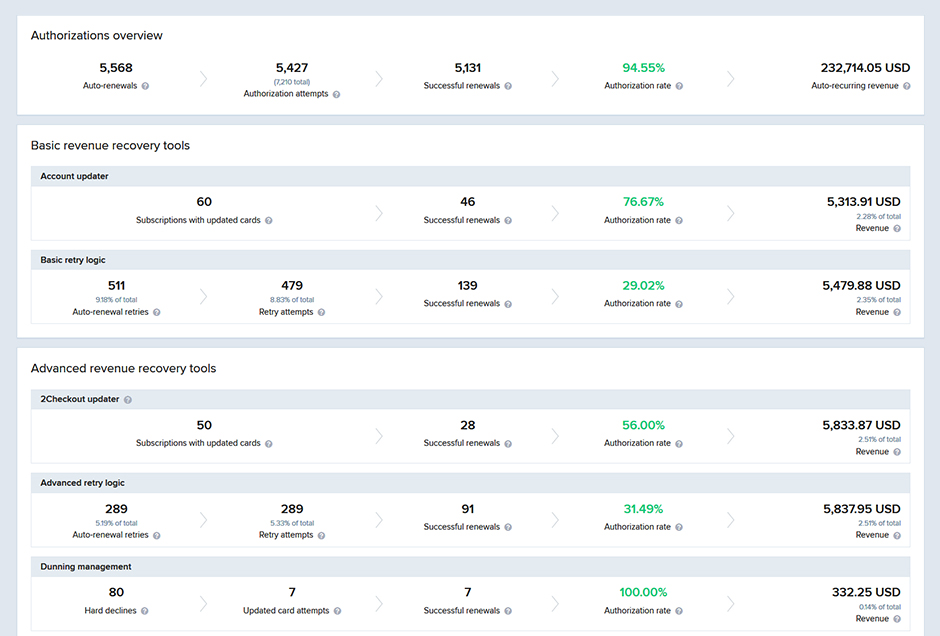

2Checkout (Verifone): Best for global sales

Overall Score

4.46/5

Payment processing pricing

4.2/5

Contract & setup

5/5

Support & reliability

5/5

Features

3.5/5

User experience

5/5

User scores

4.1/5

Pros

- Global merchant of record

- Subscription tools and analytics

- Digital cart options with more than 100 ecommerce platforms

Cons

- Weekly payout (fund transfers)

- Expensive flat-rate fees

- Lacks mobile payments (US)

Why I chose 2Checkout (Verifone)

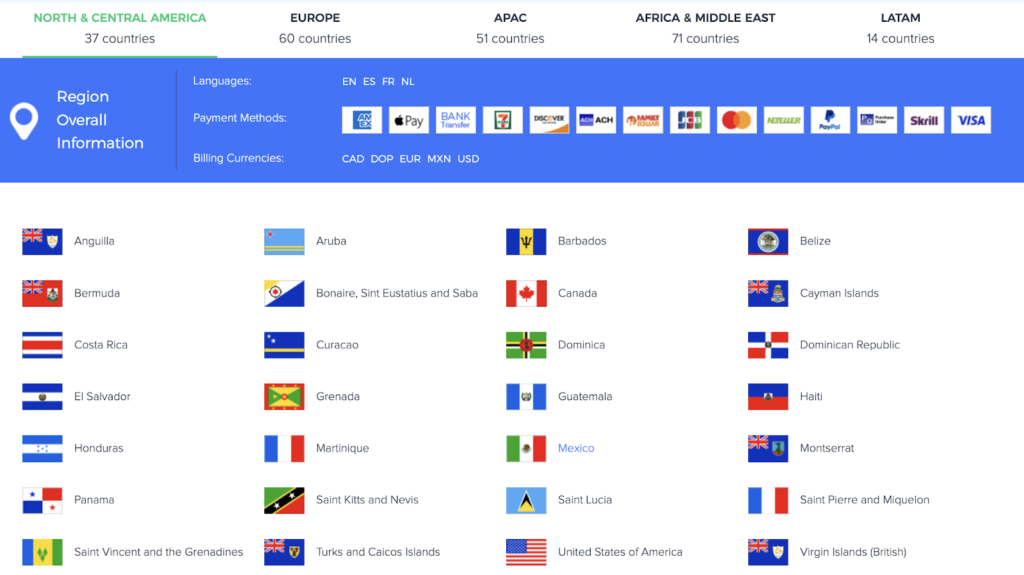

2Checkout (Verifone) made it to my list of payment gateways primarily because of its global reach. It can accept payments in more than 200 countries, in different languages and currencies. What makes it stand out for me especially is that 2Checkout can act as a merchant of record on behalf of your business, taking care of sales tax and compliance.

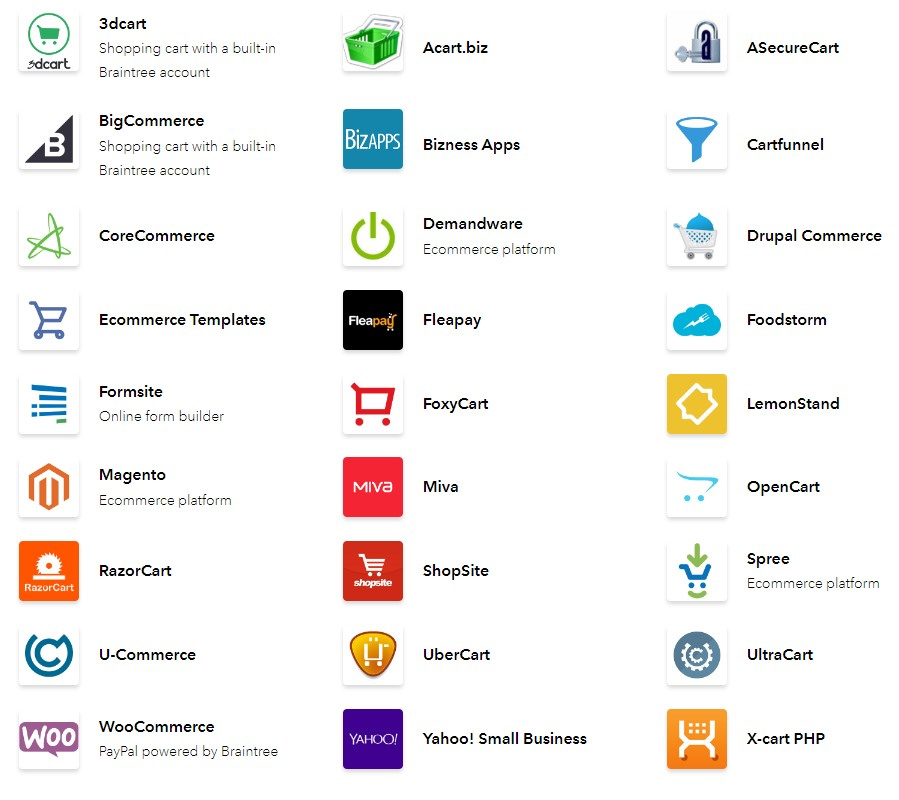

One of 2Checkout’s biggest strengths is its integration capabilities with over a hundred ecommerce platforms. It also provides shopping cart templates (checkout pages) they call Ordering Engines. It comes with plenty of templates you can customize. I was also impressed that 2Checkout can provide support for order and payment issues for your customers with 24/7 support via phone and email—globally too.

However, 2Checkout’s payouts only occur every week (seven days), which is significantly longer than the rest on this list (Authorize.net can have next-day or 24-hour payouts). There are also limited in-person payment methods available (but not available at all in the US).

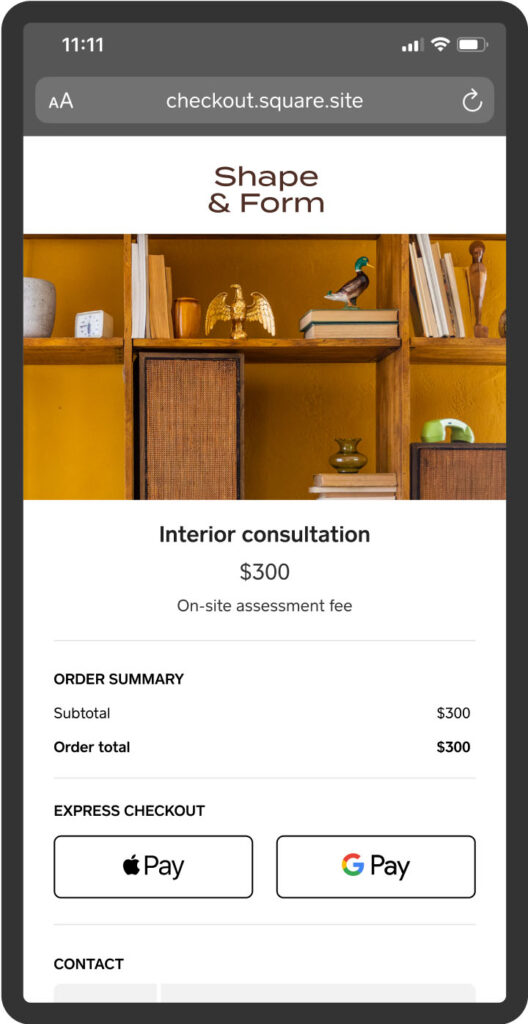

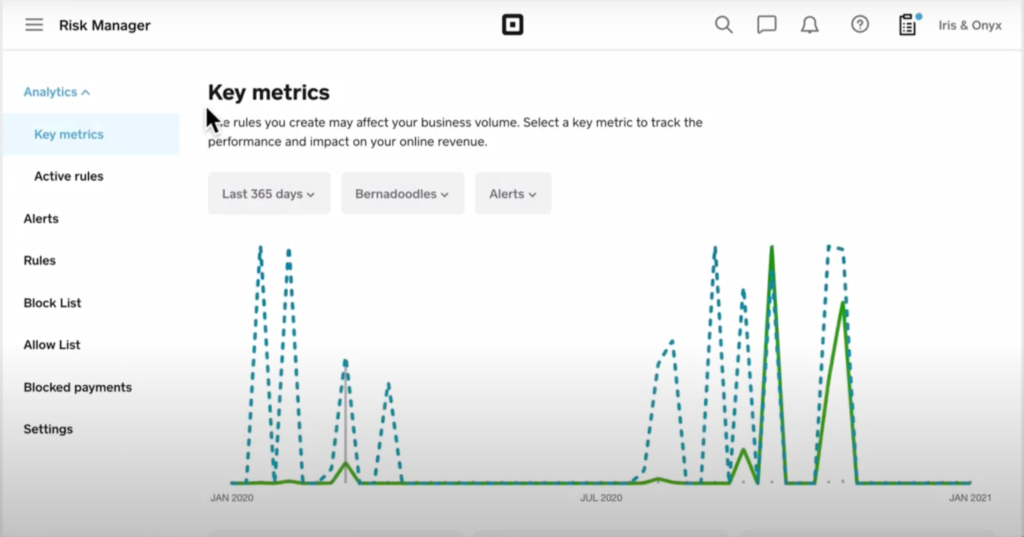

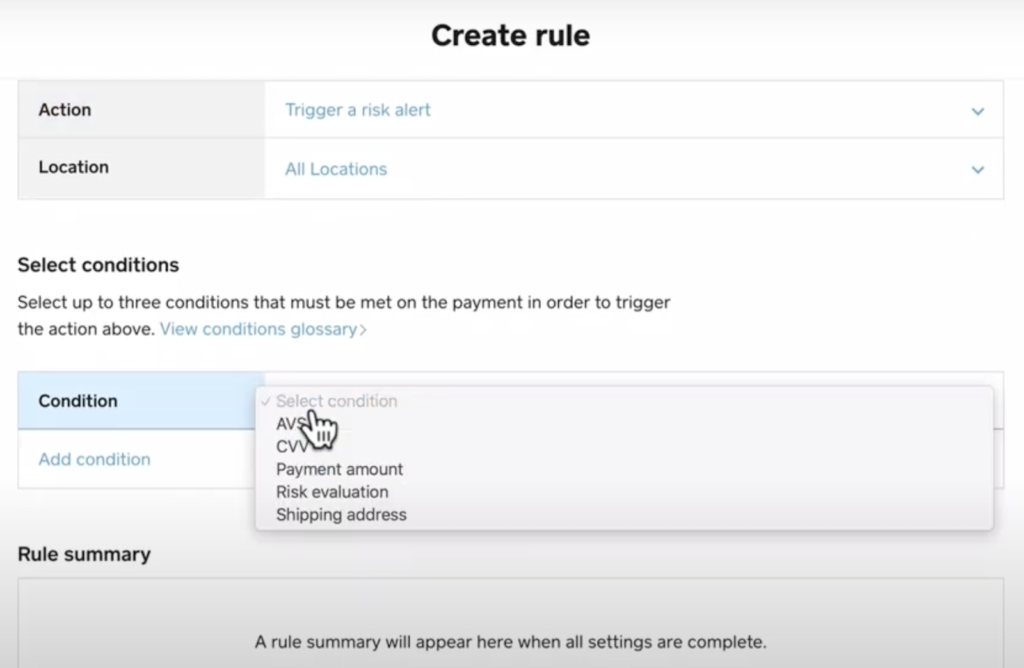

Square: Best for startups and out-of-the-box solutions

Overall Score

4.41/5

Payment processing pricing

4.17/5

Contract & setup

5/5

Support & reliability

3.13/5

Features

4.5/5

User experience

5/5

User scores

4.67/5

Pros

- Clear and straightforward pricing

- Offers a CBD merchant program

- Free Square POS hardware

Cons

- Exclusive to Square POS

- Complaints of frozen accounts

- Limited customer support hours

Why I chose Square

Among the providers I evaluated for this list, Square offers the most convenient way for new and small businesses to start accepting payments. As a payment gateway, Square has no monthly fees and does not require application or approval to sign up. You can start accepting payments at no cost.

Moreover, Square has easy-to-use tools like a POS app and ecommerce website builder you can use for free. Square Payments also has API integrations if you want to take payments on third-party sites. Overall, it’s a great out-of-the-box solution for businesses to accept and process payments.

What makes Square stand out from the rest can also be a limiting factor for some. Its solutions, while easy to use and low-cost, can be limiting for larger businesses. Square Payments requires you to use a Square POS account. Square is a clear favorite among POS solutions I have tried, but businesses with higher volume transactions or needing more customization options might find it too basic if they don’t upgrade to higher plans.

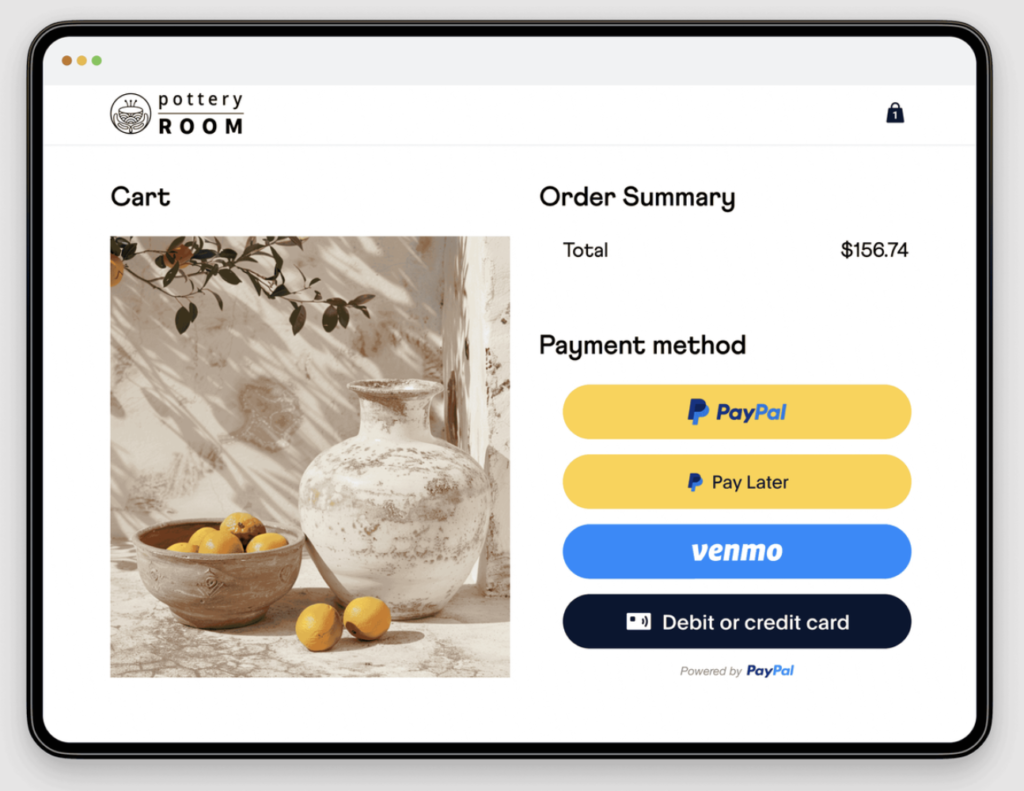

PayPal: Best for ecommerce and online shopping carts

Overall Score

4.41/5

Payment processing pricing

4.17/5

Contract & setup

5/5

Support & reliability

3.44/5

Features

4.25/5

User experience

5/5

User scores

4.6/5

Pros

- Widely-known and trusted by consumers

- Buyer and seller protection

- Instant deposits into your PayPal account

Cons

- Frequent complaints about frozen accounts

- Complicated and confusing fees

- Lacks B2B processing functionality

Why I chose PayPal

PayPal is a household name when it comes to online payments and is highly trusted by online shoppers. On average, larger businesses see a 33% increase in checkout conversion when PayPal is selected as a payment method.

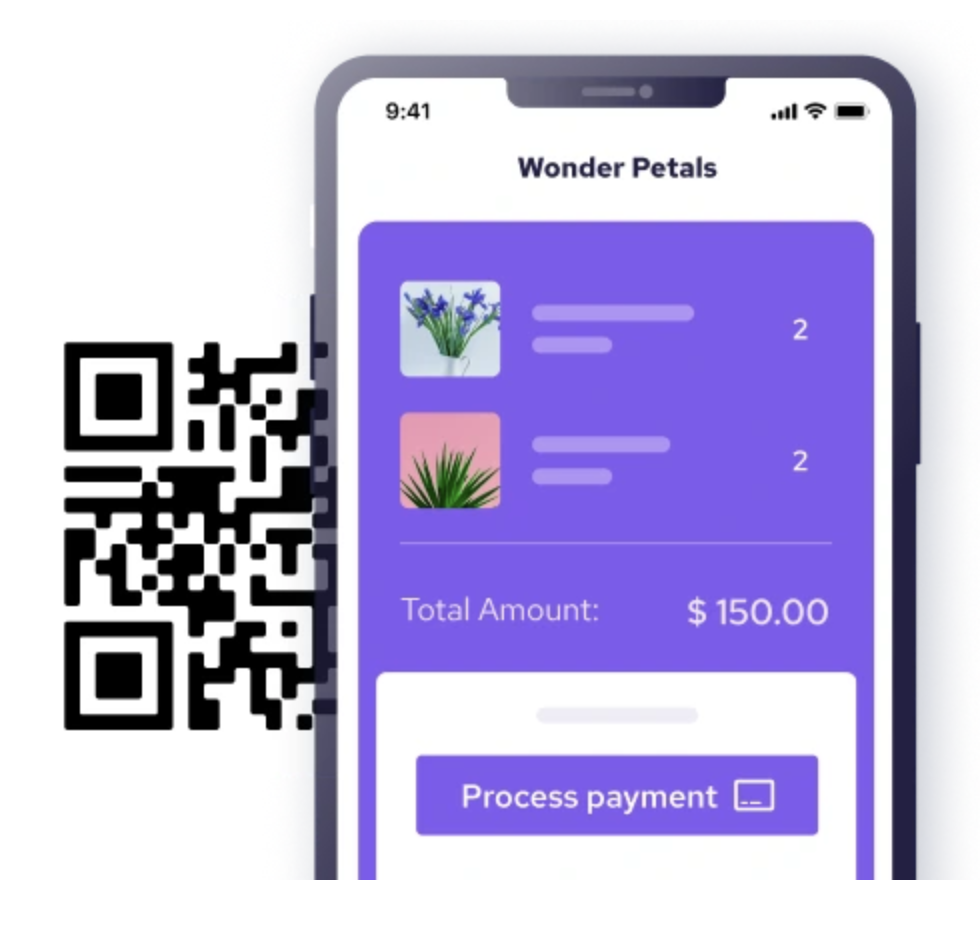

PayPal offers in-house payment processing and payment gateway-only options for other shopping carts and payment processors. But what I like most about PayPal is that it is a leader in developing and accepting new and innovative payment methods. It accepts payments through Venmo (its subsidiary), QR codes, buy-now-pay-later financing, and lately, even cryptocurrency (with varying fees). It’s hard to find a gateway that offers this many payment options seamlessly under one roof.

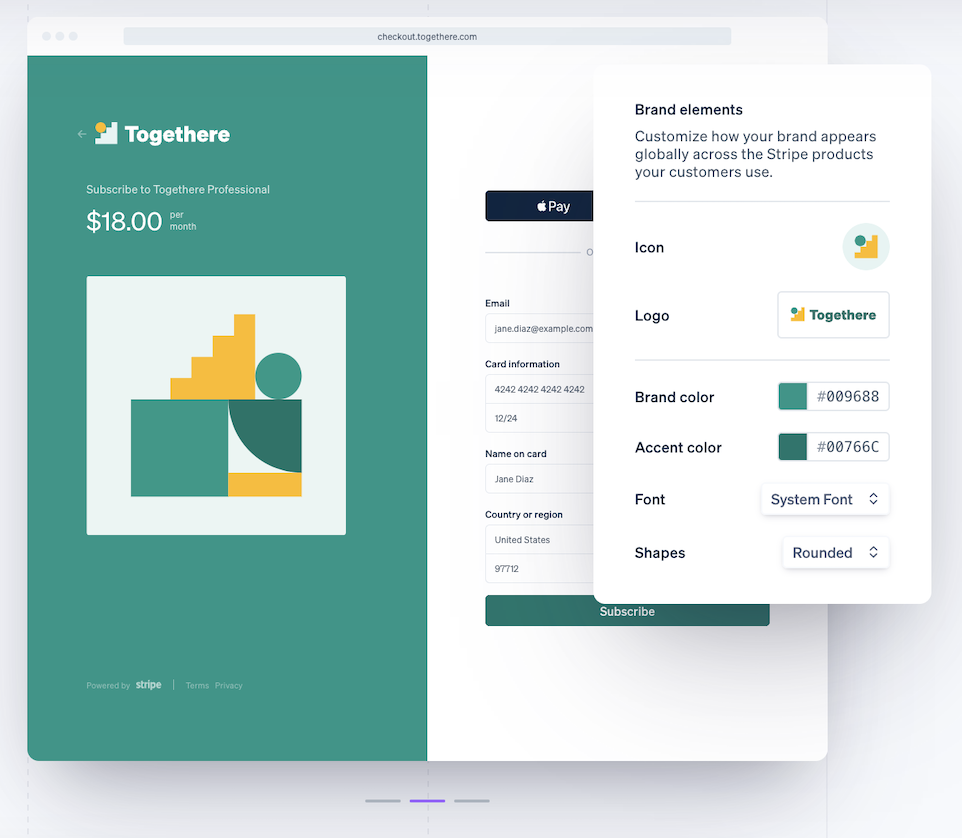

Stripe: Best for customization and multi currency payments

Overall Score

4.36/5

Payment processing pricing

4.17/5

Contract & setup

5/5

Support & reliability

4.38/5

Features

3.75/5

User experience

4.38/5

User scores

4.47/5

Pros

- Highly versatile because of customizations

- Well-documented and developer-friendly APIs

- Top-notch anti-fraud and security tools

Cons

- Limited functionality for in-person sales

- Requires coding and developer skills for customization

- Add-on fees for recurring billing and invoicing

Why I chose Stripe

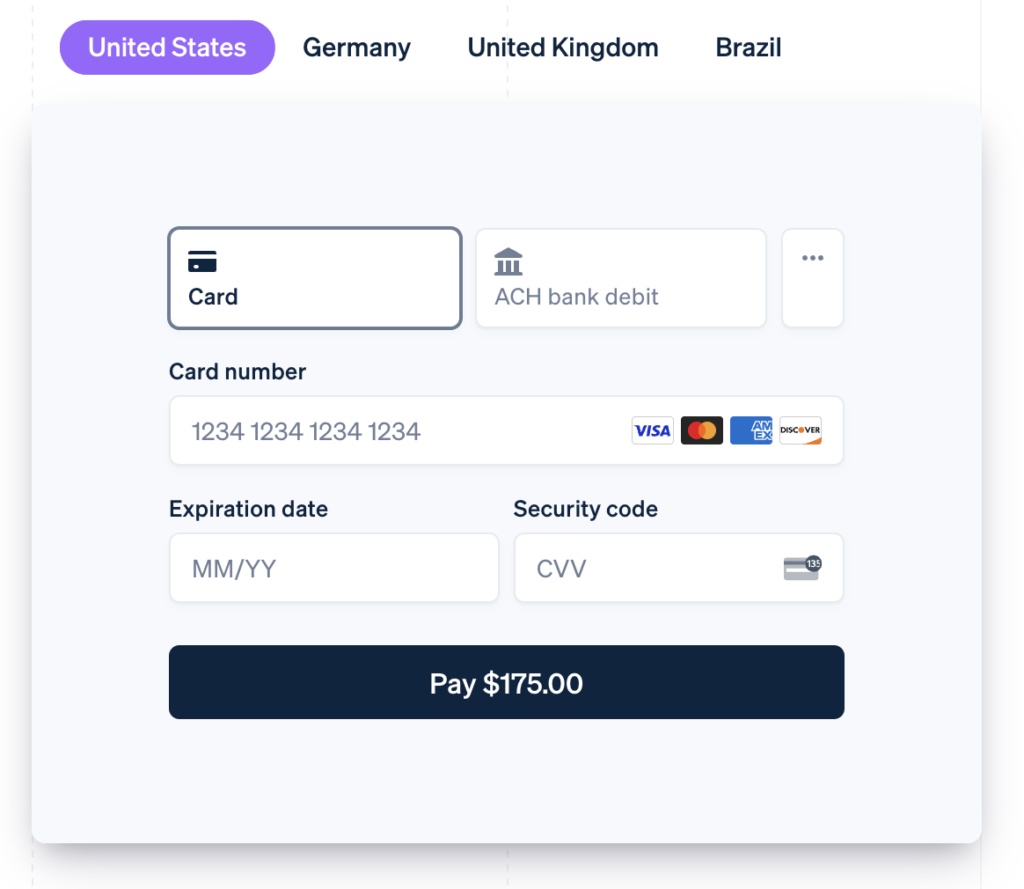

Stripe is available in 47 countries, accepts over 135 currencies, and offers dozens of different payment methods. Its advantage over other providers is that its product is designed for maximum customizability, making it the best option for businesses that want to develop a custom payment experience for their website, app, or service. It is also very developer-friendly.

Stripe’s best asset as a payment gateway is accepting international payments on dynamic checkout pages. Its customization features for language, currency, and global ID verification resources are unmatched.

If you don’t have tech know-how or don’t have the means to hire a developer, Stripe Checkout is a low-tech option that has pre-built checkout pages. You can embed this on pages or integrate using Stripe API.

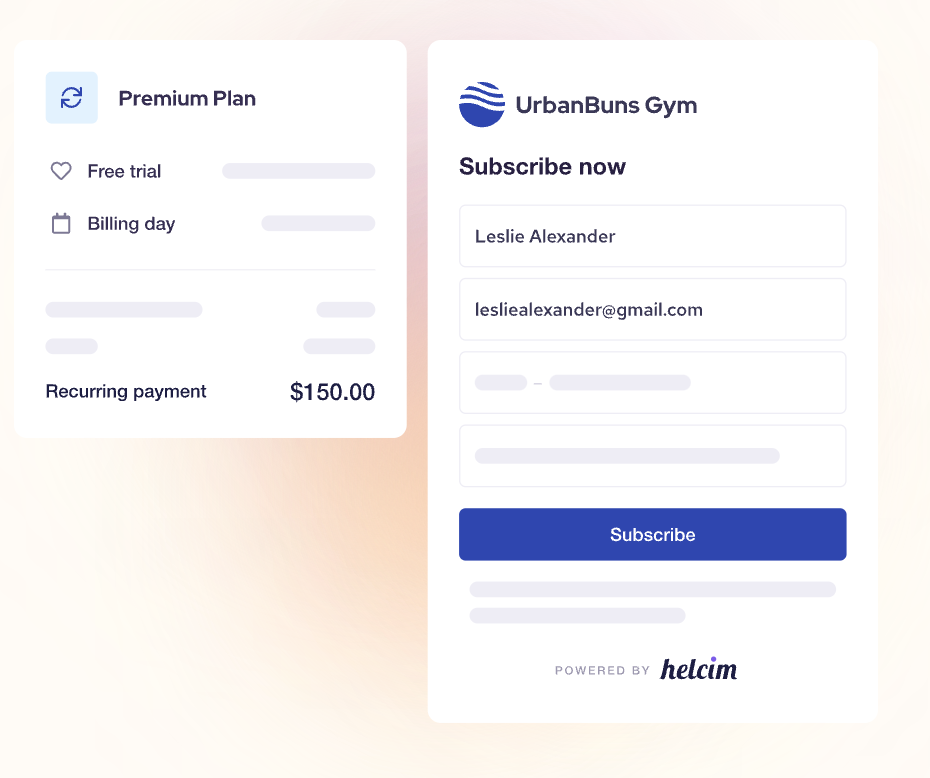

Helcim: Best for high volume transactions

Overall Score

4.23/5

Payment processing pricing

5/5

Contract & setup

3.33/5

Support & reliability

5/5

Features

3.5/5

User experience

4.38/5

User scores

4.2/5

Pros

- Interchange-plus transaction fees

- Automated volume discounts

- Free POS and online store platform

Cons

- Exclusive to businesses in the US and Canada

- No same-day deposit options available

- Limited business integrations

Why I chose Helcim

Helcim’s interchange-plus pricing model and automatic volume discounts are a perfect fit for businesses with high-volume transactions. As your sales and processing volumes increase, Helcim automatically reduces the fees they charge on each transaction. Helcim also has no monthly fees or minimum processing requirements.

Additionally, Helcim provides free POS and an online store builder, similar to Square. At the same time, it provides an API that can integrate with other shopping carts, but I find some of its integrations very limited.

Did you know? Helcim also tops our list of the best credit card processing companies.

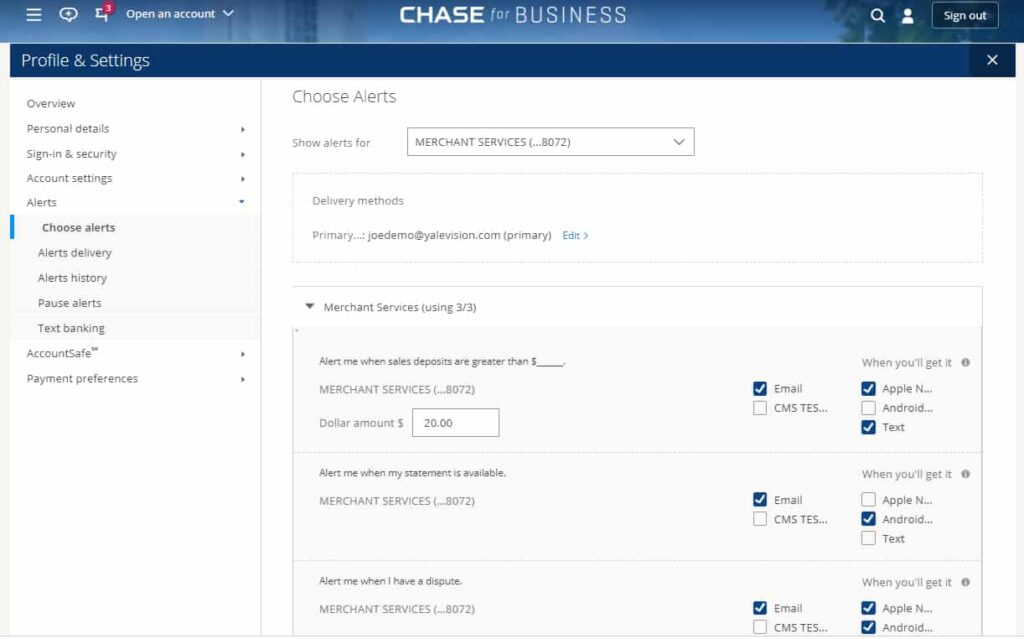

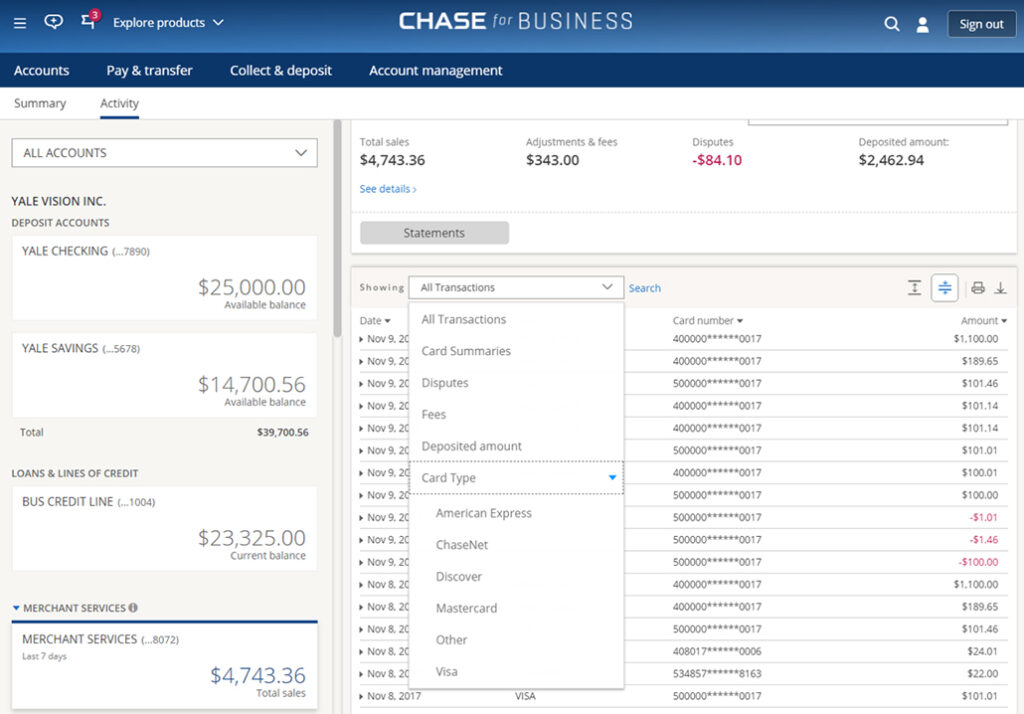

Chase Payment Solutions: Best for free same-day funding

Overall Score

4.13/5

Payment processing pricing

4.17/5

Contract & setup

3.33/5

Support & reliability

4.69/5

Features

4.5/5

User experience

3.75/5

User scores

4.33/5

Pros

- Two-in-one—process and acquiring bank

- Free same-day payouts

- Negotiable rates in some cases

Cons

- Some features require a Chase banking account—not a bad thing, unless you prefer to bank somewhere else

- Complaints of cancellation fees and poor customer support

- Unclear pricing

Why I chose Chase Payment Solutions

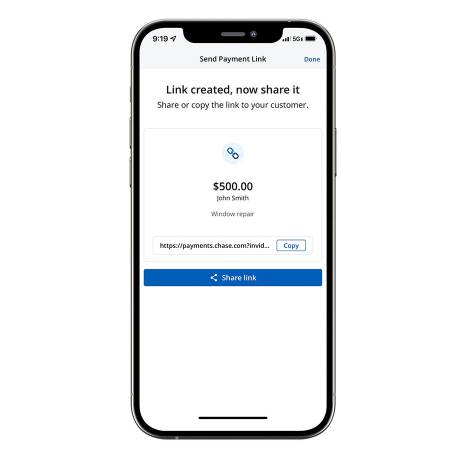

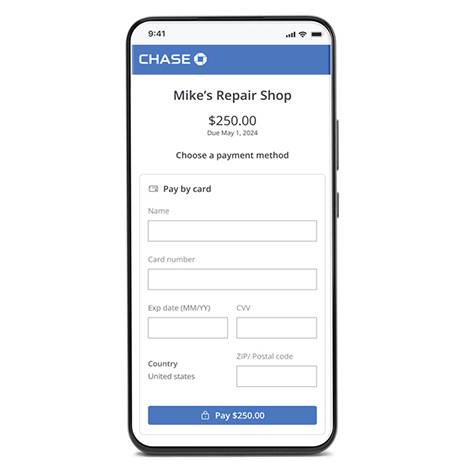

Chase is a known financial institution, offering banking services to businesses of all sizes. What I like about Chase Payment Solutions is that it is a direct processor—both a payment gateway and an acquiring bank in merchant transactions—and can streamline the process of getting paid.

I recommend opening a business checking account with Chase so you can enjoy more benefits and unlock additional features. For example, you can utilize its Quick Accept feature where you can accept payments online and in-person via its mobile app, and most importantly, get paid the same day for free.

Even without a Chase business checking account, Chase has next-day funding, unlike others on my list that take one day or longer (2Checkout even takes a week).

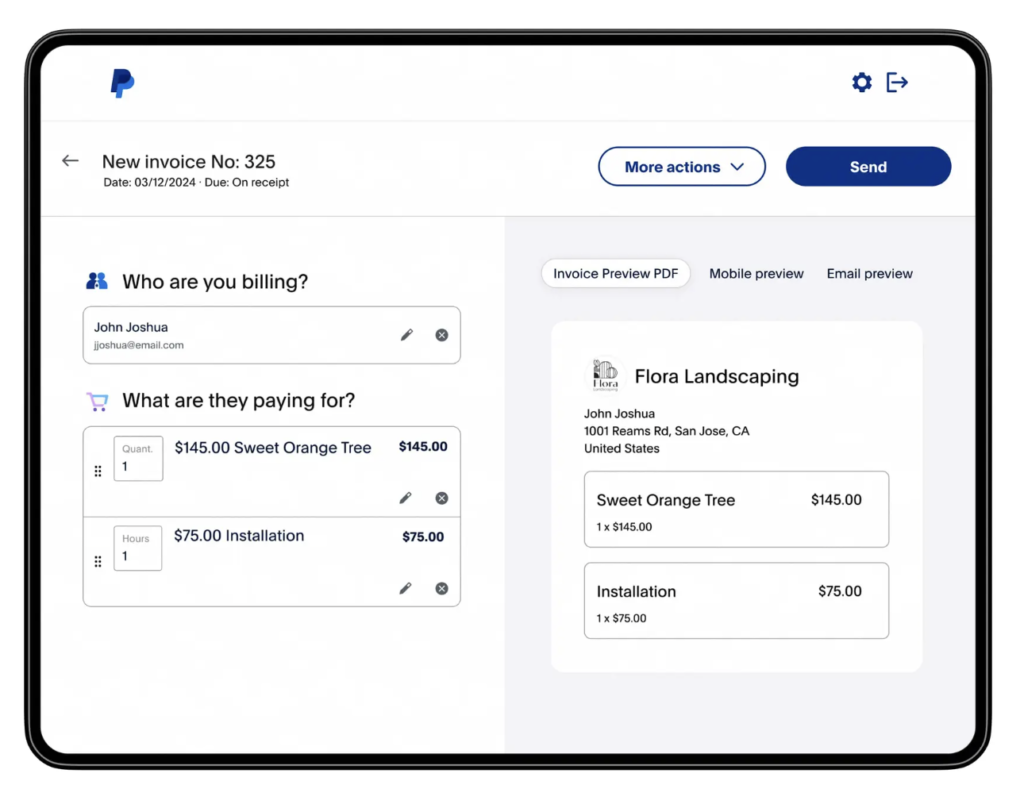

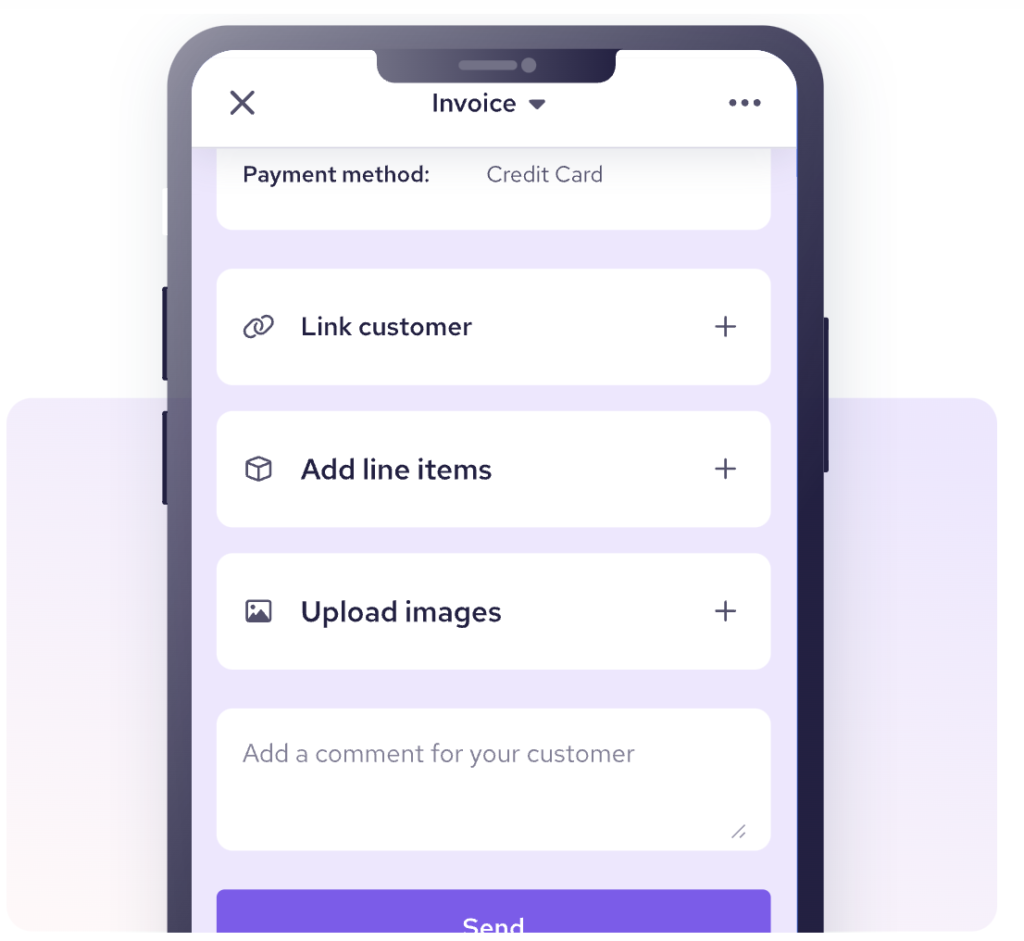

Stax: Best for recurring payments

Overall Score

3.95/5

Payment processing pricing

4.17/5

Contract & setup

4.17/5

Support & reliability

4.69/5

Features

2.75/5

User experience

3.75/5

User scores

4.17/5

Pros

- Subscription-based pricing model

- Wholesale payment processing rates

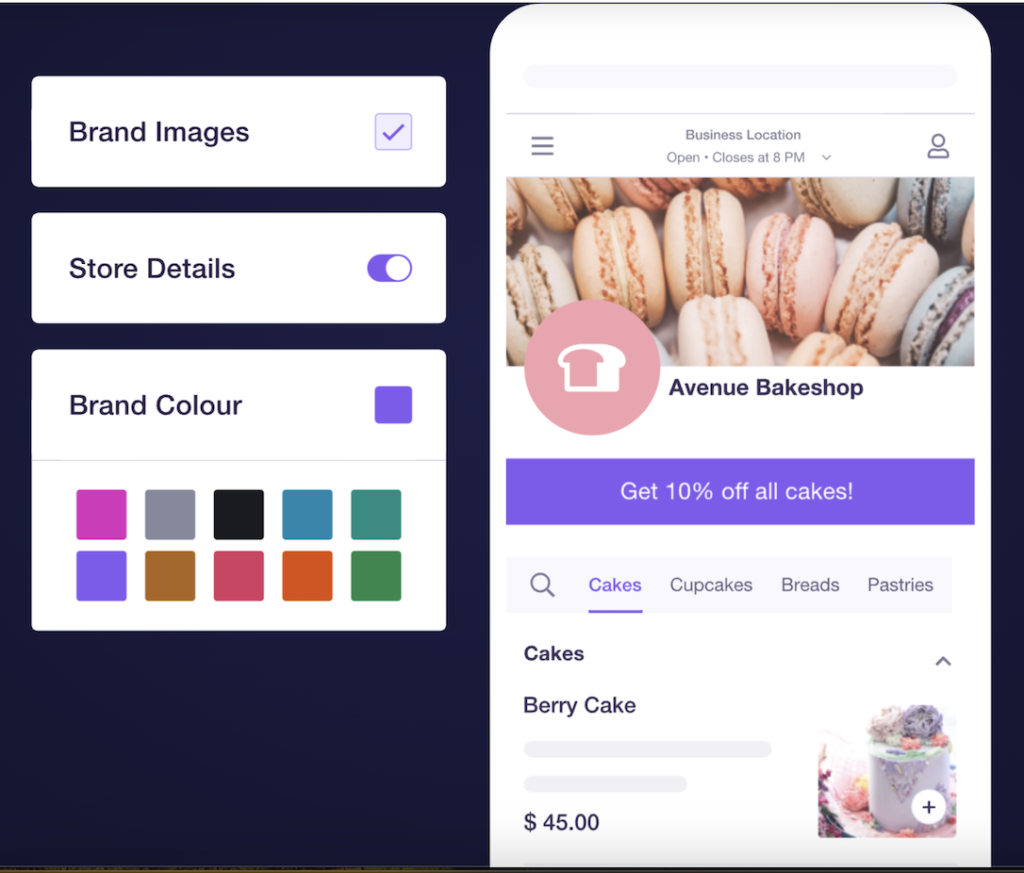

- Add-on features, like brand customization tools

Cons

- High monthly fees

- Lacks same-day fundin

Why I chose Stax

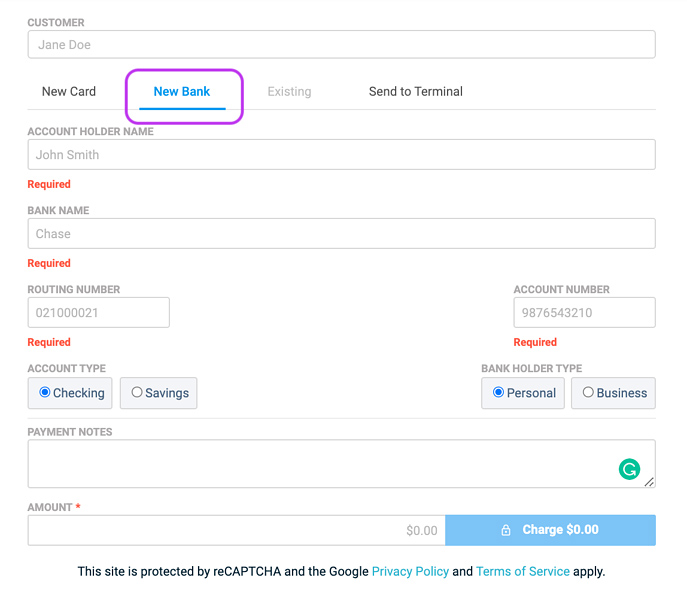

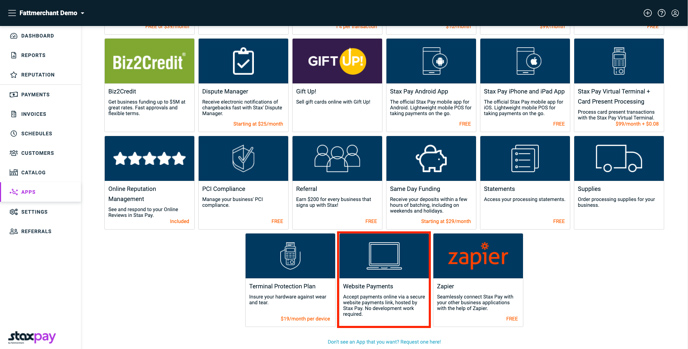

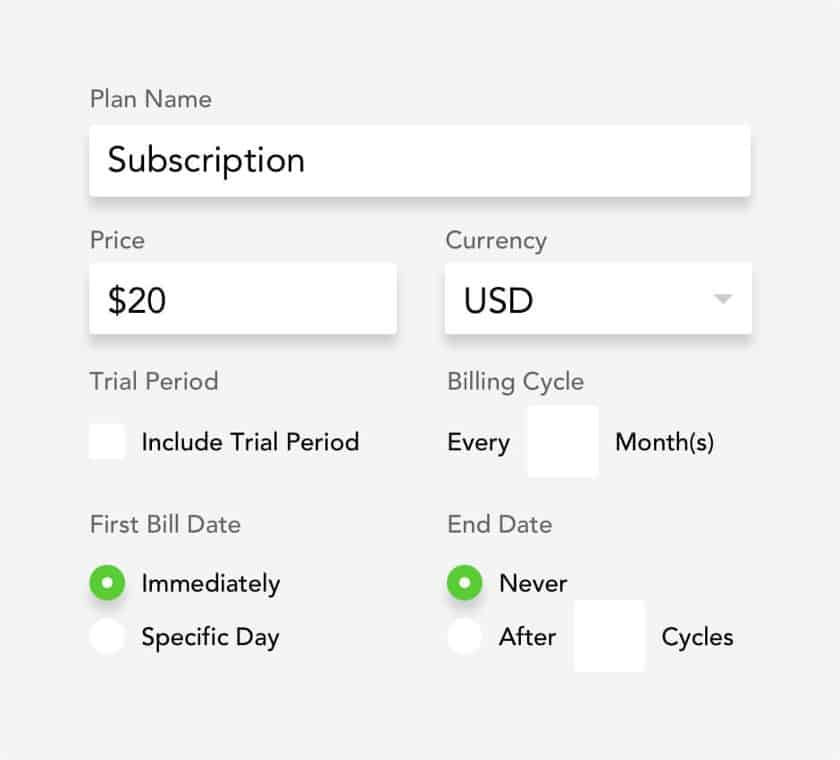

Stax (formerly called Fattmerchant) is a great choice for merchants that handle transactions mostly through invoicing or recurring billing because of its built-in features for customizing invoices and allowing customers to update cards on file. It also has customer relationship management (CRM) and fraud management tools that rival Helcim and Stripe.

It is also a good fit for businesses that process a minimum of $5,000 in monthly credit card transactions because of its subscription-based processing fees. Its monthly fee might be too expensive for small businesses with low-volume sales, but businesses processing at least $5,000 – $10,000 monthly will benefit from the lower transaction fees Stax charges in exchange for the monthly fee.

Stax is also the only provider on this list that offers surcharging through its sister company CardX, which allows you to pass along processing fees to customers.

Braintree: Best for traditional merchant accounts

Overall Score

3.94/5

Payment processing pricing

4.17/5

Contract & setup

4.17/5

Support & reliability

4.06/5

Features

3.75/5

User experience

3.75/5

User scores

3.73/5

Pros

- PayPal partnership

- International payments

- Transparent pricing

Cons

- Requires web development

- Not suited for brick and mortar businesses

- Complex user interface

Why I chose Braintree

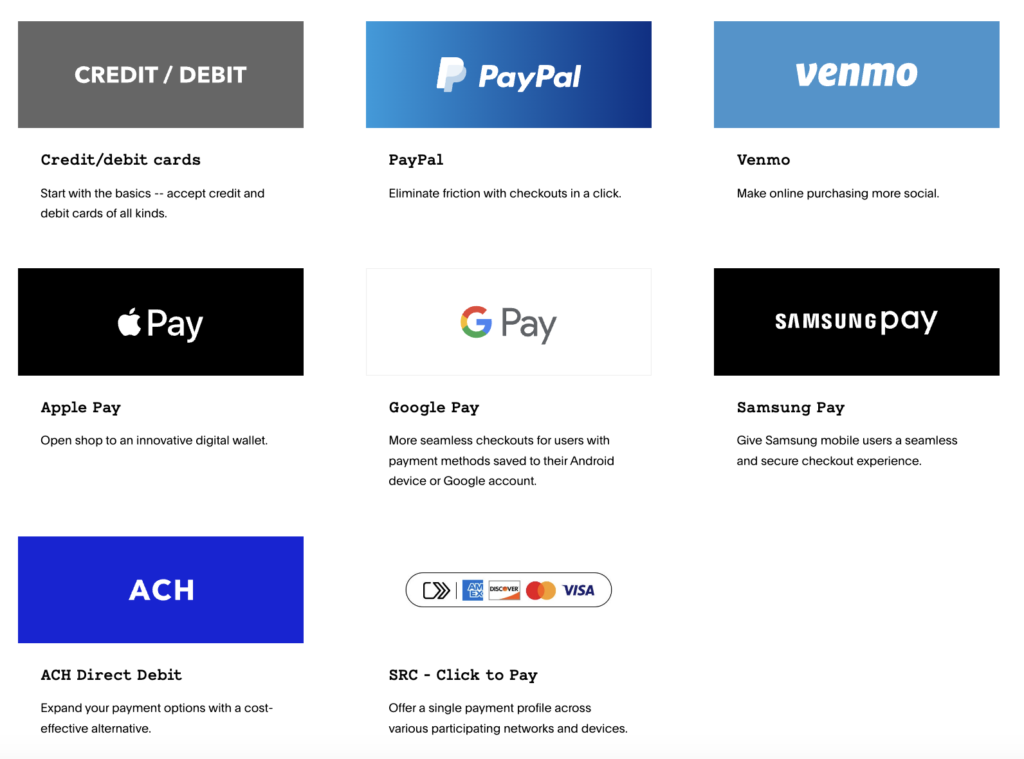

I like Braintree because it supports many payment methods, in part because of its PayPal partnership. Braintree is an all-in-one option, with gateway, processing, and merchant account features. It allows your ecommerce business to accept multiple payment methods in more than 130 currencies and more than 45 countries. There are no monthly service fees, unless you sign up for just a payment gateway.

Similar to Stripe, Braintree also offers robust developer tools, including a sandbox.

Choosing the Best Payment Gateway for Your Business

Choosing a payment gateway for your business depends on several factors. The ideal payment gateway should align with your business model, order or transaction volume, and the nature of your products or services.

Here’s how to choose the best one for your business:

1. Determine the payment features critical for your business

List all the features you need from a payment gateway. For example, if you have a subscription business, you need a provider that can store cards on file securely with auto-charging features.

- Check which payment methods the provider can accept: Credit and debit cards, ACH, echecks, wire transfers, gift cards

- Explore payment types: Invoicing, recurring billing, stored-card payments, multicurrency, level 2 and 3 data processing (used for government and business-to-business purchases)

- Look into payment security features: Tokenization, encryption, fraud detection tools, PCI security

2. Compare monthly and transaction fees

Payment gateways usually charge monthly and transaction fees. Rates are dependent on the provider’s plans and your business’ transaction volume. Some offer subscription or volume-based pricing, which can be an advantage for businesses with high transaction volumes. Understand fee structures so you can evaluate their impact on your profit margins.

3. Check integrations

Your payment gateway should seamlessly integrate with your ecommerce platform, shopping cart, accounting software, and in-store if you are receiving payments in-person. Consider whether the gateway has a pre-configured integration or if it will need to be built. Also, consider the quality of the integration, or how the software will interact with each other. Is it a one-way push? Two-way data transfer? Make sure the integration will be able to perform how you need it to.

4. Find out its reliability and read user reviews

Strong uptime guarantees are crucial so you can accept payments without disruptions. Check user reviews for real-world feedback about reliability and user experience—from client and customer (front and backend).