A high-risk merchant account is a service that allows high-risk businesses to process credit card transactions. Businesses are considered “high-risk” if they operate in a highly regulated industry, use a business model that is highly susceptible to chargebacks, or have a poor credit history.

Most high-risk merchant account services charge higher-than-average payment processing fees and have stricter application processes. However, there are providers that offer cost-effective plans and features tailored to each business’s needs.

Based on our evaluation, the best high-risk merchant account providers for 2024 are:

Software Spotlight: PaymentCloud

Flexible payment processing for any business- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Best high-merchant account providers compared

Our Rating (Out of 5)

Monthly Account Fee

Works with MATCH List*

High-Risk Account Approval Rate

Approval Processing Time

PaymentCloud

4.57

$10–$45

Yes

98%

48 hours

Durango Merchant Services

4.33

$30

Yes

Not disclosed

4–6 business days

First Card Payments

4.23

Custom

Yes

Not disclosed

24–48 hours

High Risk Pay

4.21

$9.95

Yes

99% (95% for bad credit)

24–48 hours

Flowhub Pay

4.13

$0

No

Not disclosed

1 business day

*The Member Alert to Control High-Risk Merchants (MATCH) list is a register of all merchants that have had their accounts terminated in the past. Previously known as terminated merchant file (TMF) list, these businesses were found to be in violation of their merchant services agreement. Businesses remain on the MATCH list for a period of seven years.

PaymentCloud: Best overall high-risk merchant account provider

Overall Score

4.57/5

Pricing

4.38/5

Features

4.75/5

Support & Reliability

4.69/5

User Experience

4.38/5

Average User Review Scores

4.65/5

Pros

- Customizable fee structure

- Payment gateway agnostic

- Free credit card processing

- Works with MATCH list businesses

Cons

- Monthly fees

- Lacks same-day funding option

Why I chose PaymentCloud

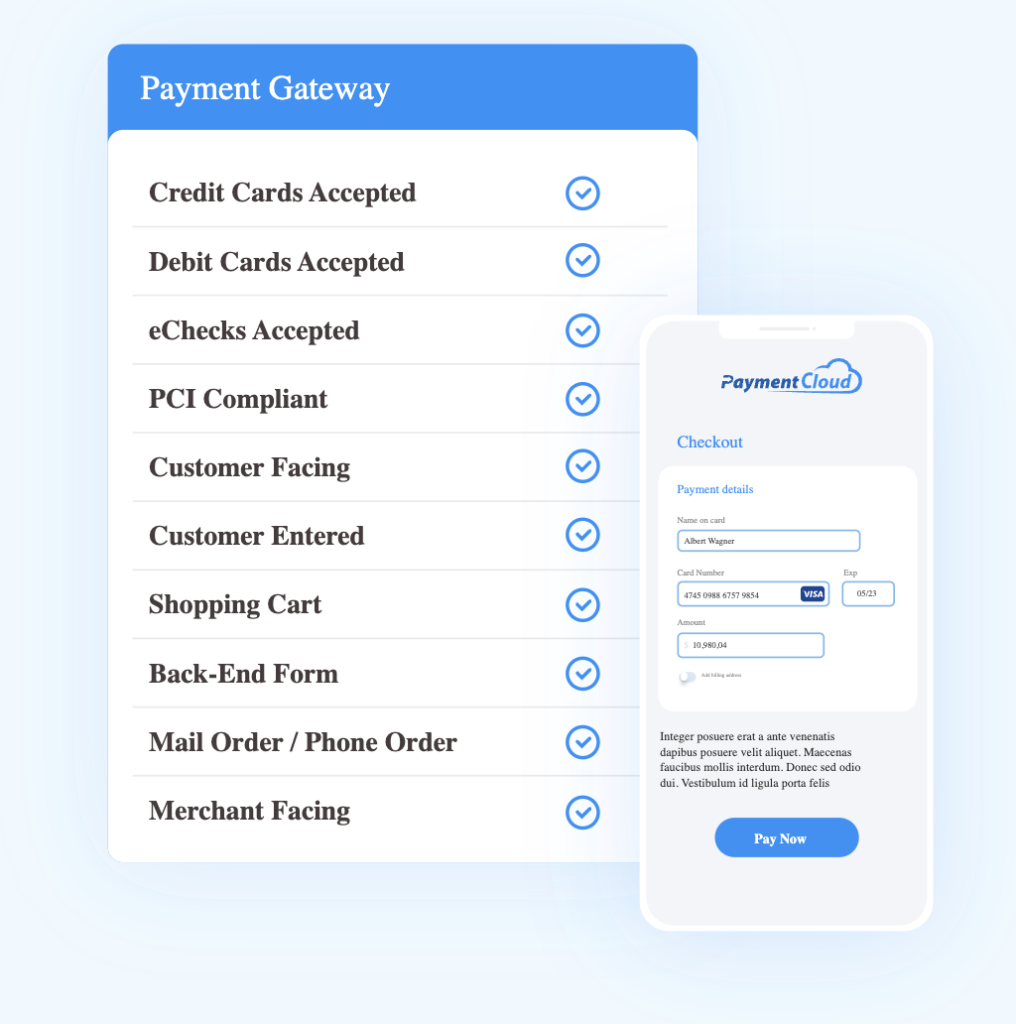

PaymentCloud is a high-risk payment processor known for its white-glove account management service. It supports a long list of high-risk industries, offering top-notch application and onboarding assistance to potential clients. PaymentCloud specializes in working with businesses included on the MATCH list. Other payment processors, including Payline Data, partner with PaymentCloud to offer high-risk merchant services.

I like PaymentCloud’s versatility and overall highly customizable payment processing tools, which allow the provider to tailor services specifically to what a business needs. PaymentCloud can customize its pricing structure according to what clients are used to. It can also integrate with any payment gateway, so companies can continue using their current platform and avoid unnecessary business interruption.

PaymentCloud is compatible with most popular point-of-sale (POS) systems like Clover and offers a free smart terminal for every merchant account.

Durango Merchant Services: Best for businesses in hard-to-place industries

Overall Score

4.33/5

Pricing

4.38/5

Features

4.5/5

Support & Reliability

4.38/5

User Experience

4.38/5

Average User Review Scores

4/5

Pros

- Specializes in hard-to-acquire credit card processing

- Supports omnichannel payments

- Local and international banking relationships

- Dedicated account managers

Cons

- Lacks same-day funding option

- Does not work with marijuana-related businesses

Why I chose Durango Merchant Services

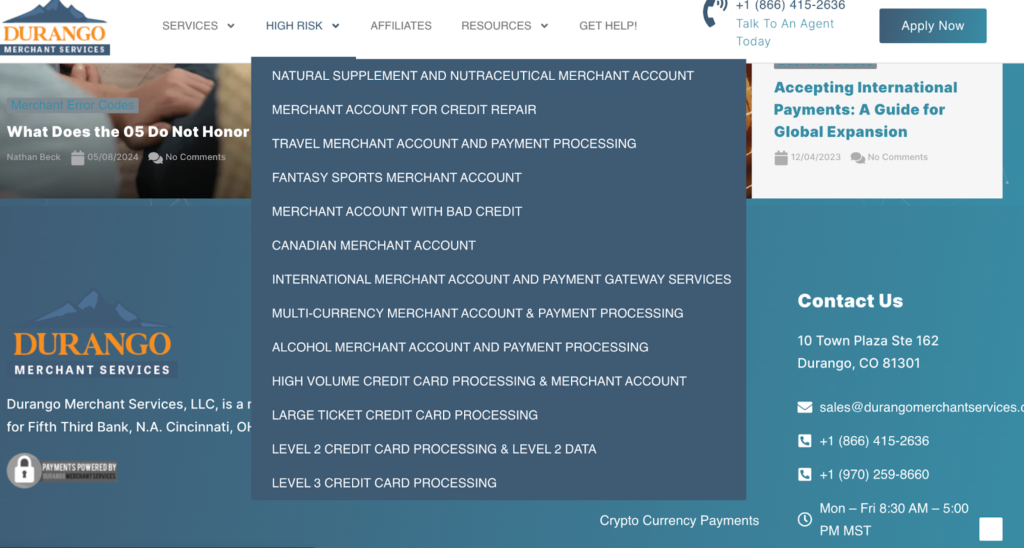

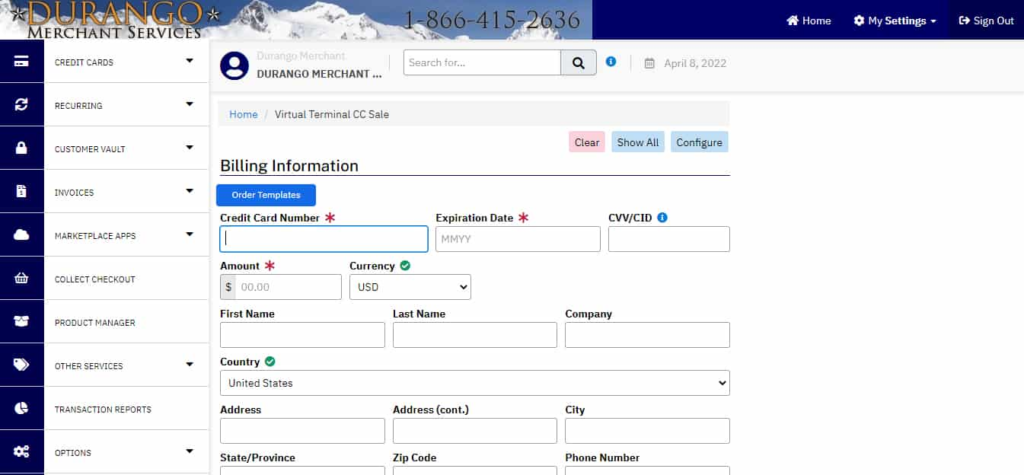

With over 25 years in the industry, Durango Merchant Services (DMS) has developed a reputation for successfully providing merchant accounts to hard-to-place businesses such as auction houses, art dealers, adult content services, money remittances, and payday loans. It provides potential clients with dedicated high-risk expert account managers, plus a long list of local and international banking relationships, to increase their chances of getting approved for a merchant account.

Durango Merchant Services has had great success with providing merchant accounts to businesses that have already been declined by other providers. Like PaymentCloud, it works with businesses on the MATCH list and offers customized pricing based on a combination of factors such as risk, credit, and payment collection method.

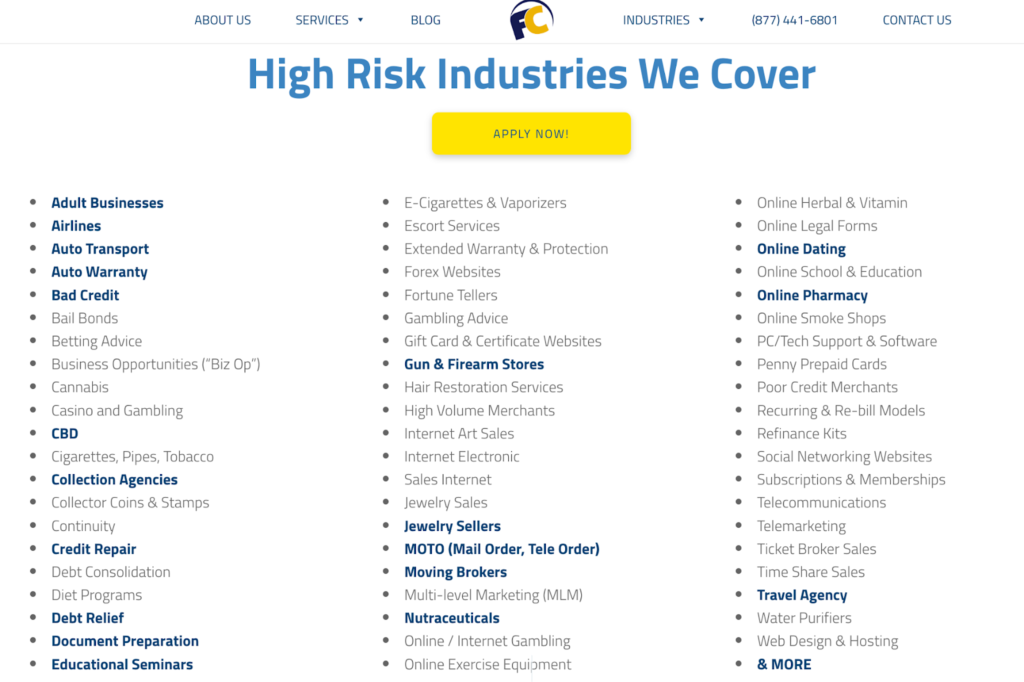

First Card Payments: Best for high-risk B2B transactions

Overall Score

4.23/5

Pricing

4.38/5

Features

4.5/5

Support & Reliability

4.38/5

User Experience

4.38/5

Average User Review Scores

3.5/5

Pros

- Flexible rates

- Mostly month-to-month contract

- Works with MATCH list businesses

Cons

- May not be the best option for new businesses

- Long-term contract for certain cases

- Not a lot of information on the website

Why I chose First Card Payments

First Card Payments is a one-stop-shop payment solution for high-risk merchant accounts. With over two decades in the industry, First Card Payments has built relationships with over 30 banks and independent sales organizations (ISOs) to provide in-person and online payment processing services as fast as 24 hours. First Card Payments also claims that it can ensure at least 25% savings on a company’s current fees for 99% of its clients.

First Card Payments works with businesses on the MATCH list and companies with at least six months of credit card processing history. It specializes in B2Bs, providing tailored payment processing services, competitive pricing, and advanced fraud protection features. There are no application fees, set-up fees, or long-term contracts for 90% of their clients.

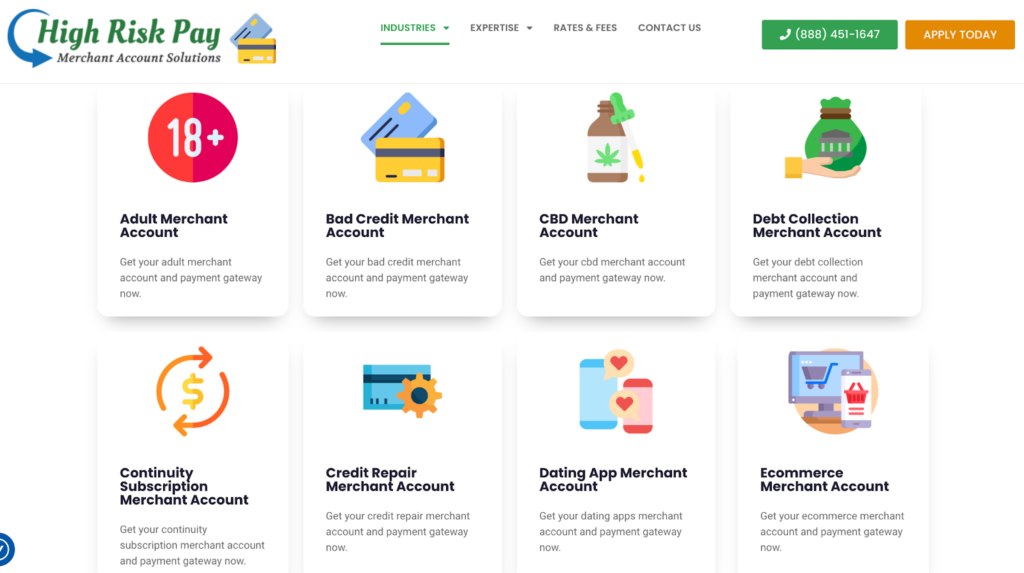

High Risk Pay: Best for businesses with poor credit history

Overall Score

4.21/5

Pricing

4.06/5

Features

4/5

Support & Reliability

4.38/5

User Experience

4.69/5

Average User Review Scores

3.9/5

Pros

- Approvals as fast as 24 hours

- High approval rate for businesses with bad credit rating

- Low monthly fee

Cons

- Not a lot of available information on its payment services

- Less competitive rates

- Lacks same-day funding option

Why I chose High Risk Pay

High Risk Pay is a leading provider of merchant accounts for businesses with bad credit ratings. It boasts a 95% approval rate for businesses with bad credit and 99% approval rate for all other high-risk merchant accounts.

Aside from high approval rates, High Risk Pay is also known for its fast turnaround time for approvals. Businesses can be approved for a merchant account in as fast as 24 hours. High Risk Pay also works with businesses in the adult entertainment, CBD, and travel industries, as well as with startups, e-commerce, and subscription-based businesses that have been declined a low-risk merchant account.

High Risk Pay offers the same pricing structure to all businesses, which is unique. Most processors offer custom rates for high-risk businesses, depending on each business’ specific risk level. While this offers a lot of transparency, the flat rates offered by High Risk Pay might not be as competitive as what you may find elsewhere.

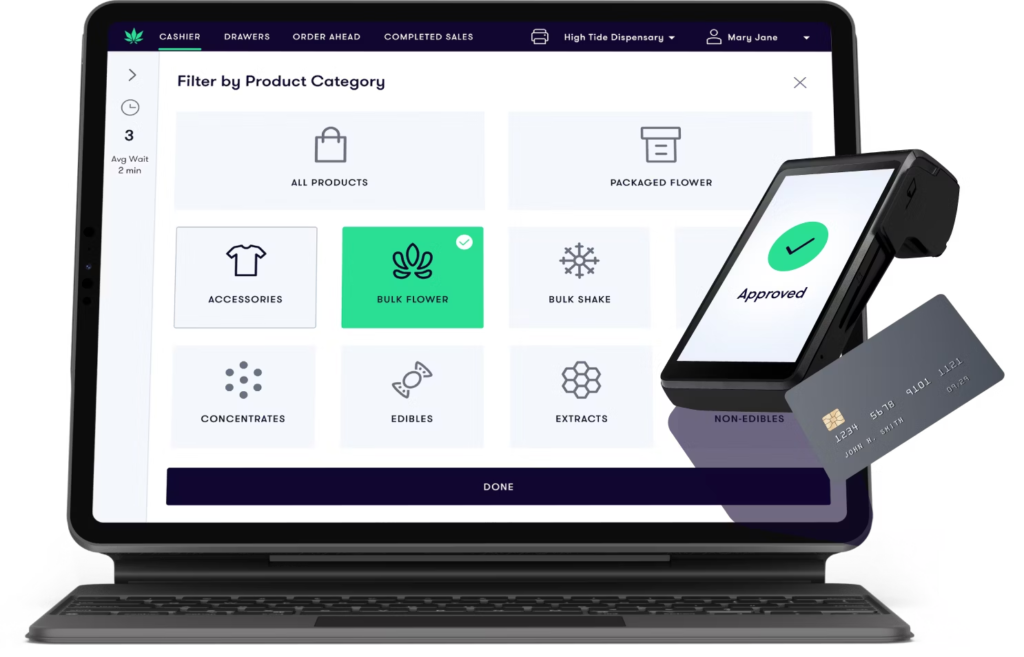

Flowhub Pay: Best for cannabis payment processing

Overall Score

4.13/5

Pricing

3.75/5

Features

3/5

Support & Reliability

5/5

User Experience

5/5

Average User Review Scores

3.9/5

Pros

- Fully compliant payment processing service

- One-day set-up

- No monthly or processing fees

- Works with cannabis POS systems

Cons

- Does not accept credit card payments

- Convenience fee on customers per transaction

- Requires a one-time hardware and setup fee

Why I chose Flowhub Pay

Selling and distributing cannabis products is a highly regulated activity that classifies any business involved in this trade as high risk. While most of the providers on our list also support cannabis businesses, we wanted to include an option that is already fully compliant and comes with industry-specific features. Flowhub Pay is a payment processing service specifically for cannabis businesses.

In compliance with regulations around cannabis sales, Flowhub Pay provides you with a merchant account for ACH and debit card payments instead of credit cards. This payment processor is integrated with Flowhub POS but can also work as a standalone terminal and alongside other cannabis POS software. If you are having difficulty securing a business bank account (a problem often faced by cannabis businesses), Flowhub can recommend you to their network of reputable banking services.

What is a high-risk merchant?

A high-risk merchant is a business that banks and other financial institutions consider “high-risk.” This can be due to any number of factors, including the industry the business operates in, the rates of chargebacks it receives, credit score, and more. Ultimately, businesses deemed high-risk are seen as risky or bad investments for banks. This is why it is harder to get approved for a merchant account, and those merchant accounts often have higher fees than low-risk businesses.

What makes a business high-risk?

A business will be considered high risk if it falls into any one of the following:

Included on the MATCH list

Businesses included in the MATCH list are there because they violated the terms of their merchant account agreement, which resulted in the termination of their merchant account. Making sure that a business is not on the MATCH list is a standard step when approving a merchant account.

High chargeback rates

Some industries are more prone to chargeback claims than others. When businesses fail to manage chargeback claims or have a business practice that results in an abnormally high amount of chargebacks, their chargeback rate increases. This can be due to a lack of fraud prevention tools or weak payment processing policies. Businesses with a high chargeback rate (typically > 1%), are classified by banks as high-risk.

Examples of businesses susceptible to high chargeback rates include:

- Businesses with a high volume of card-not-present transactions (including multicurrency)

- Businesses offering subscription services, particularly those on auto-renew

- Businesses that require product shipping

Unpredictable sales

Banks avoid any financial uncertainty, especially when it can lead to a loss on an investment. This includes providing a business with the ability to accept credit card payments. As a result, most banks tend to be wary of businesses that rely on inconsistent revenues such as multi-level marketing, software, and ticket sales.

Trading highly regulated products or services

Banks are inclined to reject businesses that trade highly regulated products and services. Banks are sensitive to the consequences of reputational risk that comes from supporting businesses in highly regulated industries. The increased risk of being shut down is also a major red flag for acquiring banks.

Large-ticket sales

Most banks consider businesses that sell high-value items such as jewelry, automobiles, and real estate high-risk. Banks also deem certain large businesses with high-volume sales risky, particularly B2Bs that combine factors such as shipping, card-not-present payments, and mail-order/telephone order (MOTO) transactions.

Poor or non-existent credit score

Credit scores are a major consideration for banks. Some banks even require a minimum number of months/years of credit card processing for businesses to qualify for a merchant account. Even then, poor business or personal credit scores will classify you/your business as high-risk and will result in a rejection of your low-risk merchant account application.

What to look for in a high-risk merchant account

Consider the following criteria when choosing a high-risk merchant account:

Industry expertise

You need a merchant account service provider with an extensive background in high-risk verticals. You should be represented by account managers with expertise in different industries. Their website should tell you how much they are familiar with the industry you belong to, enumerating their solutions to challenges specific to high-risk businesses similar to your own. The right provider will give you the best chance of being approved for a merchant account.

Client support

Unlike standard or low-risk merchant accounts, high-risk businesses will need all the help they can get to ensure account approval. This is why it’s important to choose a merchant account service provider that offers extensive client support from the moment you start your application and gather supporting documents until you finish the onboarding process. The best ones will assign you a dedicated account manager throughout your contract.

Secure payment processing services

Businesses have varying payment processing needs, especially high-risk types. Some may need the ability to accept multi-currency payments, while others will look for alternative payment methods such as ACH and the ability to add convenience fees. It is important to look for a merchant account services provider that can meet your requirements while also providing the highest security to minimize fraud and chargebacks.

Scalability

Being classified as a high-risk business should not limit your capacity for growth. The best high-risk merchant account service providers can offer a wide range of customizations that can scale along with the business. It should support integrations with reputable business systems and assist in upgrading the client’s payment processing tools as its needs change over time.

Flexible pricing and contract terms

Most high-risk merchant account providers do not disclose their pricing because of the unique requirements of high-risk businesses. That said, the advantage of custom pricing is that you only pay for services that your business really needs.

Choose a provider that can adapt your preferred pricing structure while also providing you with alternatives. Look into the contract terms, as most high-risk merchant accounts can qualify for short-term contracts nowadays. Finally, weigh the benefits of working with a familiar pricing structure vs. potentially higher savings.

Finding the right high-risk merchant account for you

When choosing a high-risk merchant account service provider, risk management should be as important as maximizing your savings. So, while budget and revenue are priorities, your decision should also factor in the company’s ability to support your unique requirements with industry expertise, the highest security measures, and flexible payment services.

We highly recommend PaymentCloud if you need a high-risk merchant account that can provide you with top-notch client support and payment services customized to your needs, from pricing to hardware.

We believe that Durango Merchant Services (DMS) is the best option for hard-to-place businesses. DMS can provide account managers with decades of experience in high-risk industries to give you the best chances of approval.

First Card Payments’ specialization is B2B businesses. Inquire about how they can provide you with a fully customized payment gateway and seamless integration with your current business system.

For poor or bad credit history, consider High Risk Pay, which offers the fastest approval and high approval rates for a long list of high-risk businesses regardless of credit score.

Lastly, Flowhub Pay should be top of mind if you are launching a cannabis business. Its solid expertise in the industry is supported by industry-specific software, hardware, and relationships with banking services to help you get started.

Read more: Best credit card processing companies