Mobile credit card processing allows businesses to accept in-person payments away from a countertop checkout terminal. Mobile payments help manage long queues, keep your operations efficient, and offer customers convenient ways to pay — all without sacrificing data security or system stability.

Based on our evaluation, the best mobile credit card processing solutions for 2024 are:

Company

Our Score (out of 5)

Monthly Account Fee

Fee Structure

Mobile Processing Options

Helcim

4.53

$0

Interchange plus rates

Mobile Card Reader + App Smart Terminal

Square

4.44

$0–$89 (w/ POS)

Flat rate w/ option for custom pricing

Mobile Card Reader + App Smart Terminal

PayPal Zettle

4.36

$0–$30

Flat rate w/ option for custom pricing

Mobile Card Reader + App Smart Terminal

Clover

4.35

$0–$49.95 (w/ POS in paid plan)

Depends on processor

Mobile Card Reader + App Smart Terminal

Stax

4.33

$99–$199

Wholesale interchange rate

Mobile Card Reader + App Smart Terminal

CardX

4.30

$29–$199

Flat rate for debit card payments

Web-based platform Smart Terminal

Helcim: Best overall mobile credit card processing solution

Overall Score

4.53/5

Pricing

5/5

Mobile app features

5/5

Support & Reliability

4.38/5

User Experience

4/5

Average User Review Scores

4.13/5

Pros

- Mobile-optimized payment and POS software

- Automated volume discounts

- Free credit card processing program

- HIPAA-compliant for healthcare services

Cons

- Add-on fees for Amex transactions

- Third-party POS integration requires custom APIs

- Does not support tap-to-pay on iPhones

Why I chose Helcim

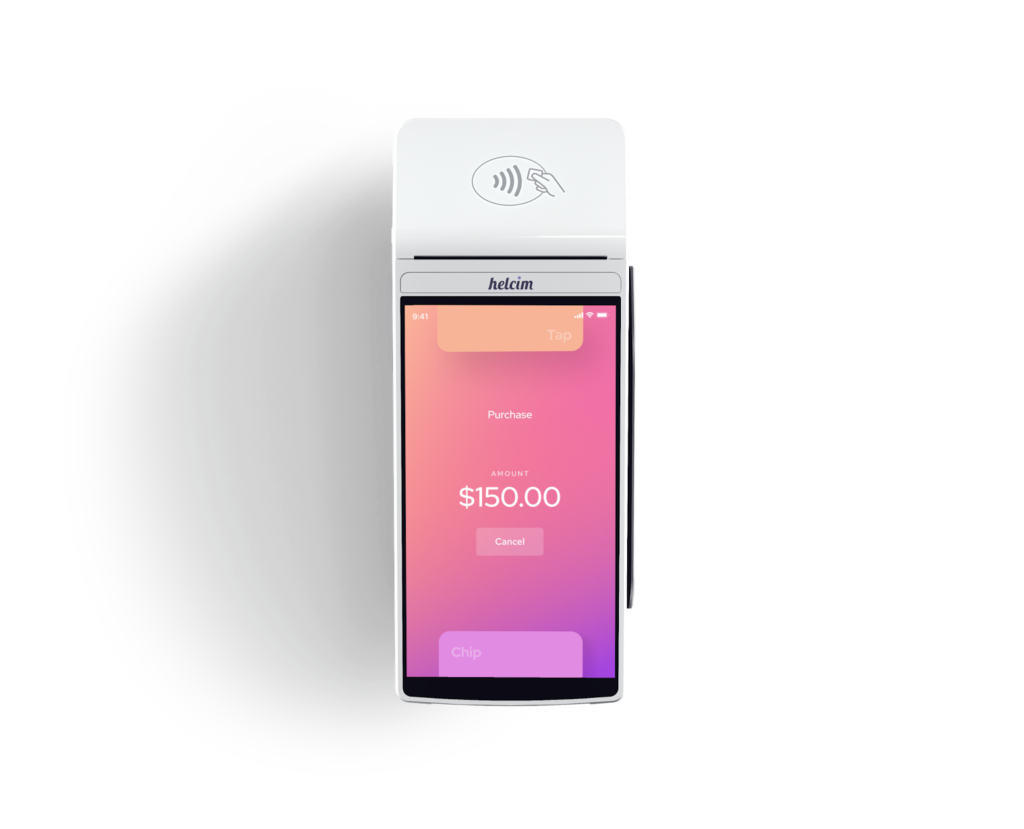

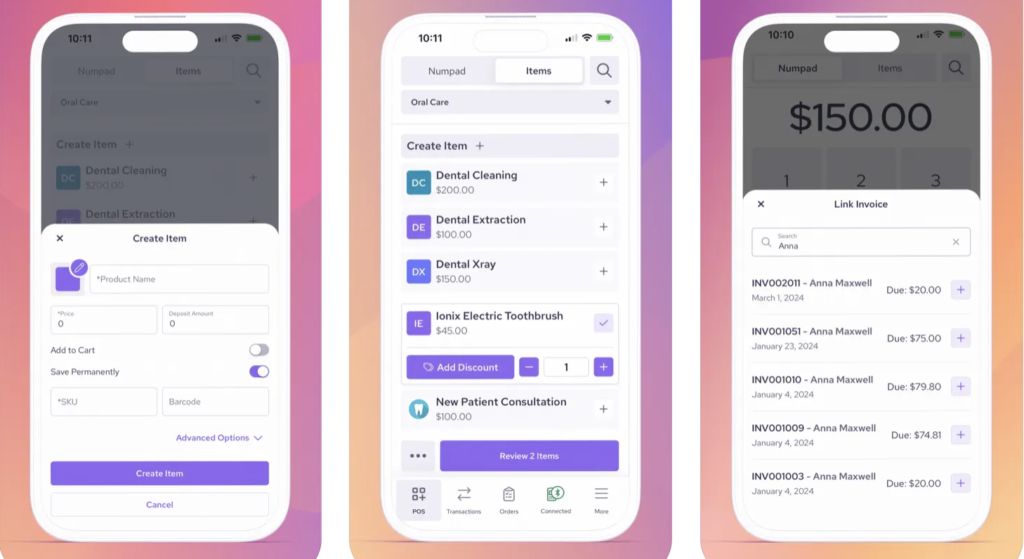

Helcim is a traditional merchant services provider that also offers simple POS software. It provides an app-based mobile payment platform, as well as a mobile payment terminal with a built-in POS. The smart terminal also has a built-in free credit card processing program (via surcharging) for in-person transactions. While the terminal is on the expensive side, Helcim does offer installment payment plans.

Helcim has several great features for growing businesses. For one, it offers an interchange plus fee structure with built-in volume discounts, so there is no need to apply for better rates at every milestone. The system is also HIPAA-compliant, so it can securely process healthcare service transactions. Helcim’s simple upgrades for its POS are limited, but custom APIs allow companies to integrate Helcim with other business software.

Square: Best for retail, wholesale, and restaurants

Overall Score

4.44/5

Pricing

3.44/5

Mobile app features

4.75/5

Support & Reliability

4.69/5

User Experience

4/5

Average User Review Scores

4.67/5

Pros

- Built-in industry-specific POS solution

- HIPAA-compliant software

- CBD program for cannabis sellers

- Available customizations for enterprise-level businesses

Cons

- Not compatible with other software

- Primarily flat rate fees, custom rates by request

- Limited customer support hours

Why I chose Square

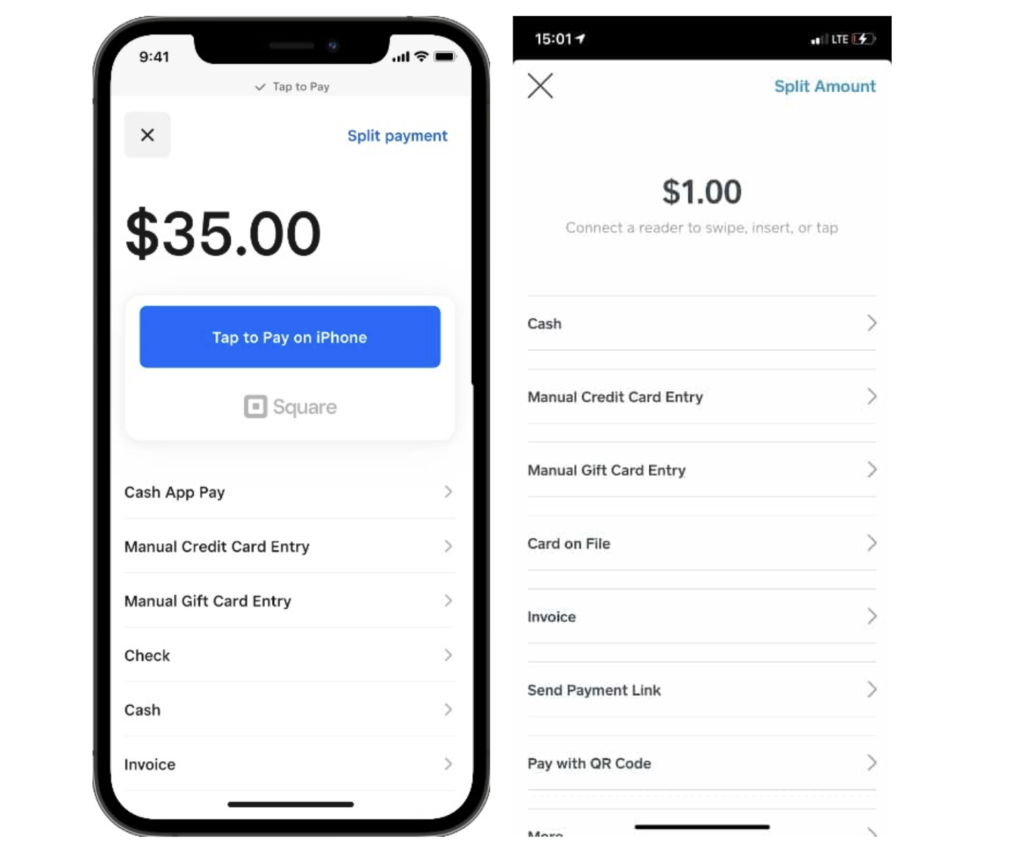

Square is a popular all-in-one POS system with a built-in payment processing feature. New and small businesses love Square because it allows them to set up and start selling with little to no upfront cost. Square offers a mobile credit card processing solution with a free mobile POS app, mobile credit card reader, and stand-alone POS terminal. It even waives up to $250 worth of chargeback fees every month.

That said, Square has also grown into efficient business software for large retailers. It offers custom rates for businesses with sales of more than $250,000 a year and uses developer APIs to connect with existing software. The Square Terminal with the built-in POS offers mobility and is perfect for large-volume sales in warehouses. Square is even HIPAA compliant (like Helcim) and can process payments for CBD businesses.

In addition to dedicated retail services, Square also offers solutions tailored to the restaurant industry. Its mobile card readers and terminals can support food trucks, cafes, and restaurants of all sizes.

PayPal Zettle: Best for global and peer-to-peer payments

Overall Score

4.36/5

Pricing

3.13/5

Mobile app features

4.75/5

Support & Reliability

4.38/5

User Experience

4.25/5

Average User Review Scores

4.57/5

Pros

- Known and trusted brand

- Global payment methods

- Instant deposits to your PayPal account

- Mobile credit card terminal for custom business software

Cons

- Lacks offline payment processing

- Dispute management feature is an add-on

- Reputation for poor customer support

Why I chose PayPal

PayPal is a well-known and trusted mobile-first payment processing platform for individuals and small businesses. Its peer-to-peer payment capabilities and instant access to funds via its digital wallet make PayPal one of the easiest to use, particularly for occasional sellers. In recent years, PayPal has made great strides in expanding its payment services to provide features for growing and large businesses.

PayPal Zettle replaced PayPal Here, PayPal’s former point-of-sale app, to provide improved in-person payment processing tools such as a stand-alone POS terminal equipped with a barcode scanner. With PayPal’s global payment methods, this particular mobile hardware will work great for selling at large trade shows and exhibits. For large businesses, PayPal also adds a modern mobile card reader that can easily be integrated with advanced customization tools designed to create a flexible payment ecosystem.

Clover: Best for payment processor flexibility

Overall Score

4.35/5

Pricing

4.38/5

Mobile app features

4.25/5

Support & Reliability

4.69/5

User Experience

4.25/5

Average User Review Scores

3.8/5

Pros

- POS software with built-in payment features

- Compatible with multiple payment processors

- Customizable checkout flow

- Can process payments offline

Cons

- Contract terms vary

- Hardware cannot be reprogrammed

- Scalability depends on the processor

Why I chose Clover

Clover is a POS software provider that also offers proprietary hardware with built-in payment processing tools. The system is owned by Fiserv (formerly First Data) and, by default, applies Fiserv rates when purchased directly through Clover. That said, Clover’s unique value proposition is that the software and hardware are resold through ISOs and resellers on the Fiserv network, including popular processors such as Stax, PaymentCloud, and Dharma Merchant Services.

This means that businesses can choose from a number of payment processors to use Clover, each offering different contract terms, risk tolerances, additional services, and fee structures. Clover is also equipped with developer-based and API customization tools, plus a list of third-party custom integration services to scale the system and meet large business needs. However, it is important to note that once purchased and programmed, Clover hardware cannot be reprogrammed to work with a different processor, so choose wisely.

Stax: Best for large-volume sales and scalability

Overall Score

4.33/5

Pricing

4.69/5

Mobile app features

4.5/5

Support & Reliability

4.06/5

User Experience

4.5/5

Average User Review Scores

3.93/5

Pros

- Wholesale subscription rates

- Payment services for SaaS platforms

- All-in-one API for customizations

- Billing and surcharging tools for large businesses

Cons

- Limited mobile hardware options

- Terminal protection fee on top of equipment cost

- Lacks same-day funding functionality

Why I chose Stax

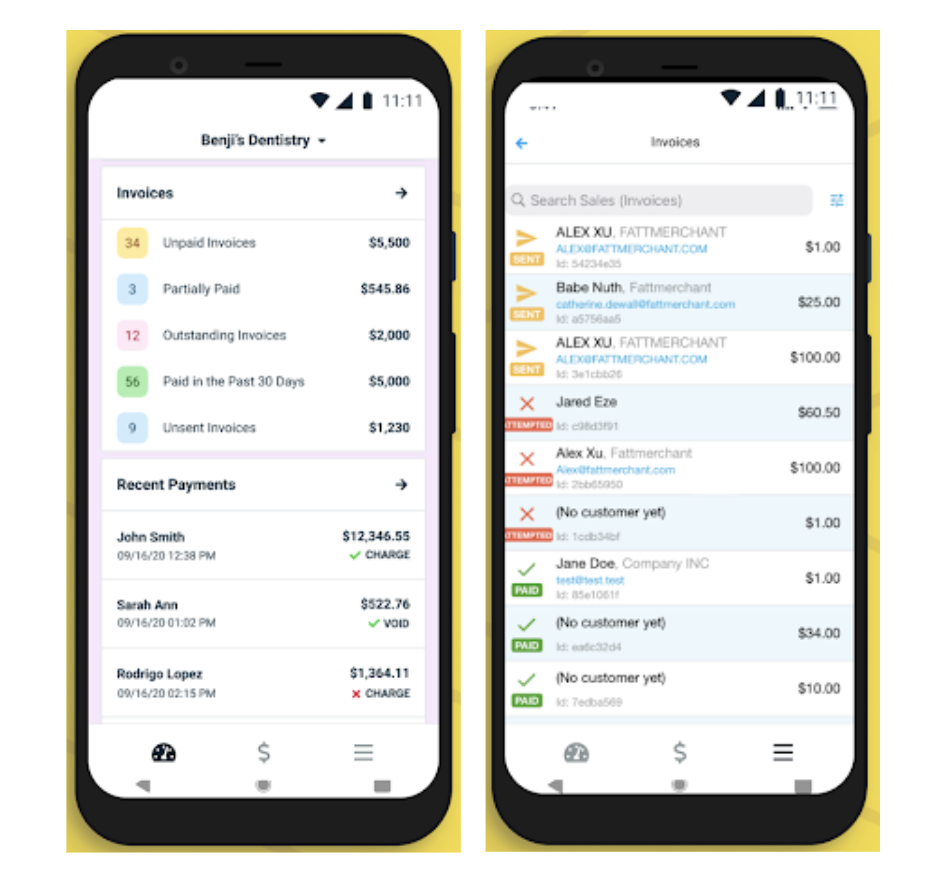

Stax is a traditional merchant service offering wholesale subscription rates, which are ideal for midsize to large businesses. It is our top choice for scalability because everything about Stax is designed to keep up with growing demands for payment features and services. Businesses can choose from a range of options, from hardware to customization tools.

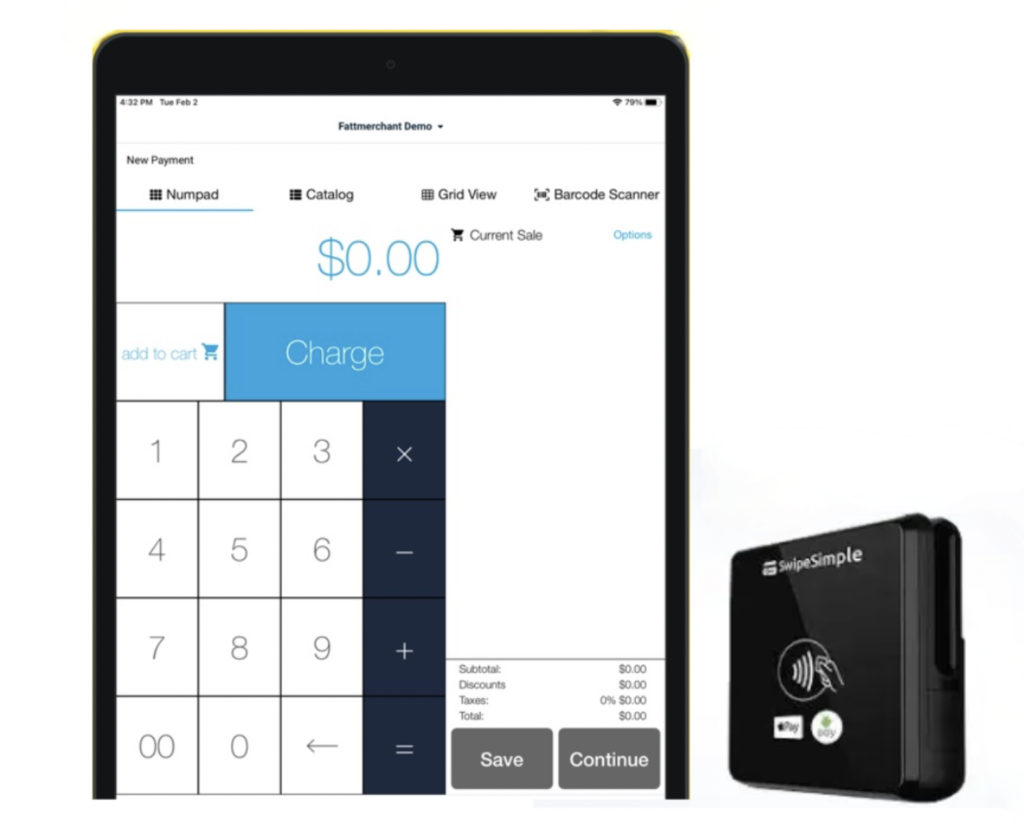

This means even its mobile payment processing service can be customized to match unique business needs. Stax has the SwipeSimple mobile card reader configured to work with the Stax Pay mobile app. It also supports Dejavoo and Clover smart terminals for businesses that need more advanced payment features while accepting payments on the go, such as tableside ordering and sales in restaurants. Stax’s payment technology is also equipped with tools to integrate with proprietary business software.

CardX: Best for surcharging

Overall Score

4.3/5

Pricing

4.06/5

Mobile app features

4.75/5

Support & Reliability

4.06/5

User Experience

4.5/5

Average User Review Scores

3.5/5

Pros

- Exclusive Mastercard surcharging partner

- Auto surcharging for in-person transactions

- Works in conjunction with other payment processors

- Volume-based monthly plans

Cons

- Limited mobile hardware options

- Customizations depend on payment processor

- Lacks same-day funding

Why I chose CardX

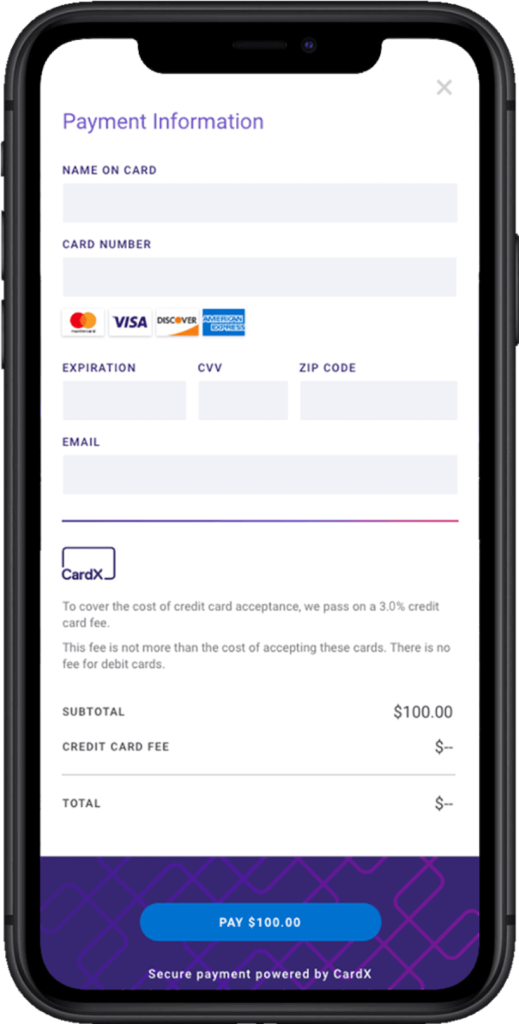

More and more payment processors are offering surcharging capability, and the service is becoming increasingly popular with merchants and other businesses. However, CardX remains the most reliable. CardX is an active participant in shaping surcharging laws in the U.S., making it THE expert in surcharging compliance. It offers surcharging programs for both online and in-person transactions while working with other payment processors.

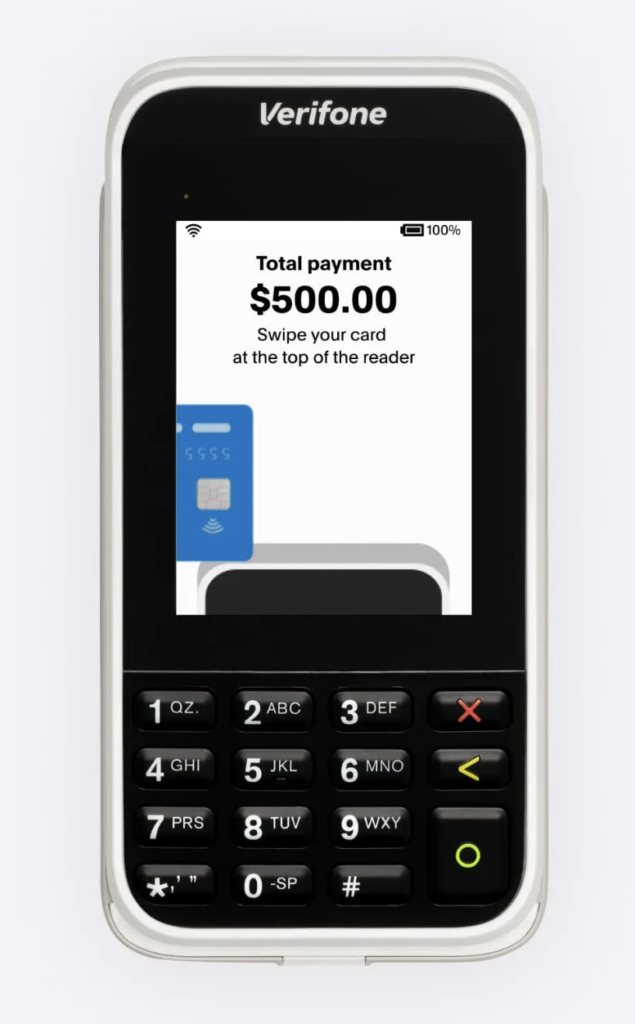

CardX uses the Dejavoo smart terminal to accept in-person credit and debit card payments. The hardware comes with CardX’s payment platform, which supports invoicing and subscription management. CardX does not have app-based software, but its web platform is mobile-optimized, so users can make manual entry payments from a mobile device. CardX can operate alongside other payment processors, including those that cater to larger businesses like Stax.

Key components of mobile credit card processors

Mobile credit card processing solutions consist of several components that work together to provide the flexibility businesses need to maximize sales.

The most important factor to begin with is the mobile hardware. Without it, businesses would be unable to expand their sales processing away from a fixed checkout terminal. Providers should ideally have different options, from standard mobile credit card readers to full-on stand-alone payment terminals. The hardware should be durable and reliable to avoid any delays in processing transactions.

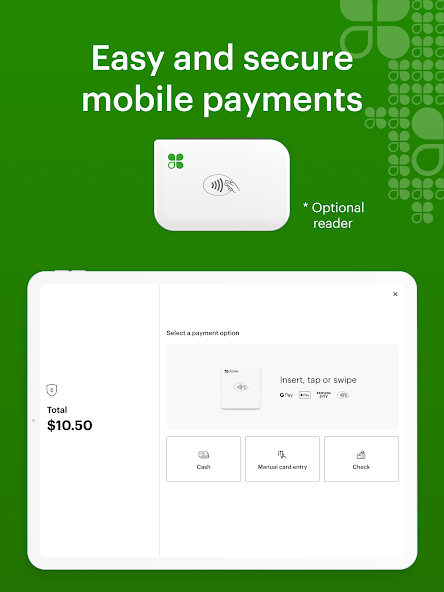

Businesses will also need mobile payment software that goes along with the hardware. App-based mobile software (on a smartphone or tablet) that connects with a mobile credit card reader is the most popular option. On the other hand, smart terminals are becoming increasingly popular, as they come with their own built-in platform programmed by the payment processor.

These mobile software include POS solutions with varying degrees of functionality. While some allow for just basic payment processing, others come equipped with full inventory management and CRM solutions.

Connectivity is also an important component when using mobile payment software. Businesses need a smartphone or tablet that supports Bluetooth to connect the mobile payment app with the mobile credit card reader. Internet connection via WiFi or data is also required to actually process payments.

Benefits of mobile credit card processing

Mobile credit card processors allow businesses to process sales tableside, curbside, and in other locations outside a brick-and-mortar shop, such as pop-up stores, food trucks, farmers markets, trade shows, and exhibits. This helps bust lines, reduce wait times, and provide a great customer experience.

Additionally, mobile credit card processors are designed for ease of use. The user interface is very similar to how smart devices work (even easier with payment apps installed on a smartphone or tablet), which means employees require minimal training to start processing sales.

Mobile credit card processing is also a cost-effective alternative to traditional setups. Mobile payment apps are often free, and some are even equipped with robust POS software at no extra cost. Most card readers are inexpensive and at times, offered for free or at a discount. If you’re looking to purchase an all-in-one smart terminal instead of pairing a smartphone with a mobile reader, many solutions, such as Square, offer interest-free installment plans on hardware purchases.

Lastly, mobile credit card processors are highly scalable. In addition to easily adding more terminals, mobile payment software can be integrated with a larger business system and even upgraded with advanced payment processing features.

Also read: Best Tablet POS Systems and Best Mobile POS Systems

Challenges of mobile credit card processing and how to overcome them

Challenge: Connectivity issues that disrupt transactions on mobile credit card processors.

Solution: Make sure there is a reliable internet connection and anticipate poor WiFi, especially when selling on the go. Be prepared with a data plan on your mobile device and consider providers that offer offline payment functionality.

Challenge: Hardware malfunction caused by limited battery life, card reader disconnection, accidental drop, or water damage during operations.

Solution: Research reviews from real-life users before purchasing hardware. Invest in high-quality mobile credit card readers/terminals and accessories such as protectors, backup batteries, and portable chargers.

Challenge: Security concerns resulting in chargebacks and compromised sensitive customer information.

Solution: Work only with Level 1 PCI-compliant payment processors. Monitor staff activity using mobile credit card terminals that support multi-user logins. The mobile card reader should be compatible with EMV chip cards and, ideally, PIN pads to ensure that customer data is encrypted during transactions.

Finding the best mobile credit card processor for you

When choosing a mobile credit card processor, the most important factor to consider is the system’s ability to provide a reliable and efficient mobile payment solution. The best mobile payment processor should, therefore, be flexible with its payment methods, cost-effective, durable, and have the ability to scale its features as your business grows.

Helcim is among the most versatile mobile credit card processors on the market. Its best asset is the ability to automate nearly all of its payment functions (including applying discounts) and customize its features with developer tools for larger businesses.

Square and PayPal are solid runners-up. Square is known for its extensive POS features, and PayPal offers a range of payment methods. Both are favorite mobile processors for new and small businesses, but they both also offer advanced customization capabilities to cater to enterprise-level sales.

Clover and Stax are on our list because of their versatility. Companies in various industries can rely on Clover’s compatibility with payment processors like Stax that offer advanced features and better transaction rates.

CardX seamlessly integrates with other payment processors that provide scalable payment services while allowing businesses to significantly minimize their costs.