The last thing a small business owner needs to learn is how to be a professional bookkeeper on top of all the other small business priorities. To make up for this, small business accounting apps have to be designed for non-accountants.

The nature of small business — where every employee fills multiple roles to keep the business moving — means that the software should strive to give business owners a tool they can learn easily and master quickly while not sacrificing more advanced features that ensure tax and regulatory compliance. Luckily, both Wave and Intuit QuickBooks are designed in this way. This article will break down the major differences for Wave vs. QuickBooks small business accounting software.

Also Read: 8 Reasons Accounting Software Isn’t Just for Big Business

Wave vs. QuickBooks is your standard up-and-comer vs. industry-standard software matchup. Both offer accounting software in the cloud, accessibility to major features through mobile apps, collaboration and user permissions for outside stakeholders, financial analytics, tax tracking, tax reporting, and helpful extras like receipt uploads via mobile phone.

In keeping with the general feature trends of financial apps, both Wave and QuickBooks connect directly to your bank accounts and credit cards to automatically import transactions, but the list of connections to outside financial tools like Square, PayPal, and ApplePay vary between Wave vs. QuickBooks. Both tools support regional tax rates and regulations like VAT, and both run as double-entry accounting ledgers suitable for professional accounting services.

Let’s look at some of the ways that Wave vs. QuickBooks differ. To look at a variety of accounting software that will meet your business’s needs, check out our Accounting Software software category page.

Table of contents

- Wave vs. QuickBooks: a side-by-side comparison

- Accounting

- Invoicing & payments

- Payroll

- Collaboration

- Reporting

- Experience vs. innovation

- Wave vs. QuickBooks: SMB accounting options

Wave vs. QuickBooks: a side-by-side comparison

| CORE FEATURES | ||

| Mobile App | No | Yes |

| 24/7 Live Support | No | Yes |

| Free Plan | Yes | No |

| Paid Payroll Option | Yes | Yes |

| Receipt Scanning | Yes | Yes |

Accounting

Both Wave and QuickBooks are set up for professional-grade accounting with double-entry ledgers, connections to your bank and credit card accounts, and the ability to build budgets. They also both offer support for multi-currency accounts, so local businesses with complicated currency situations or online shops can still use the tools.

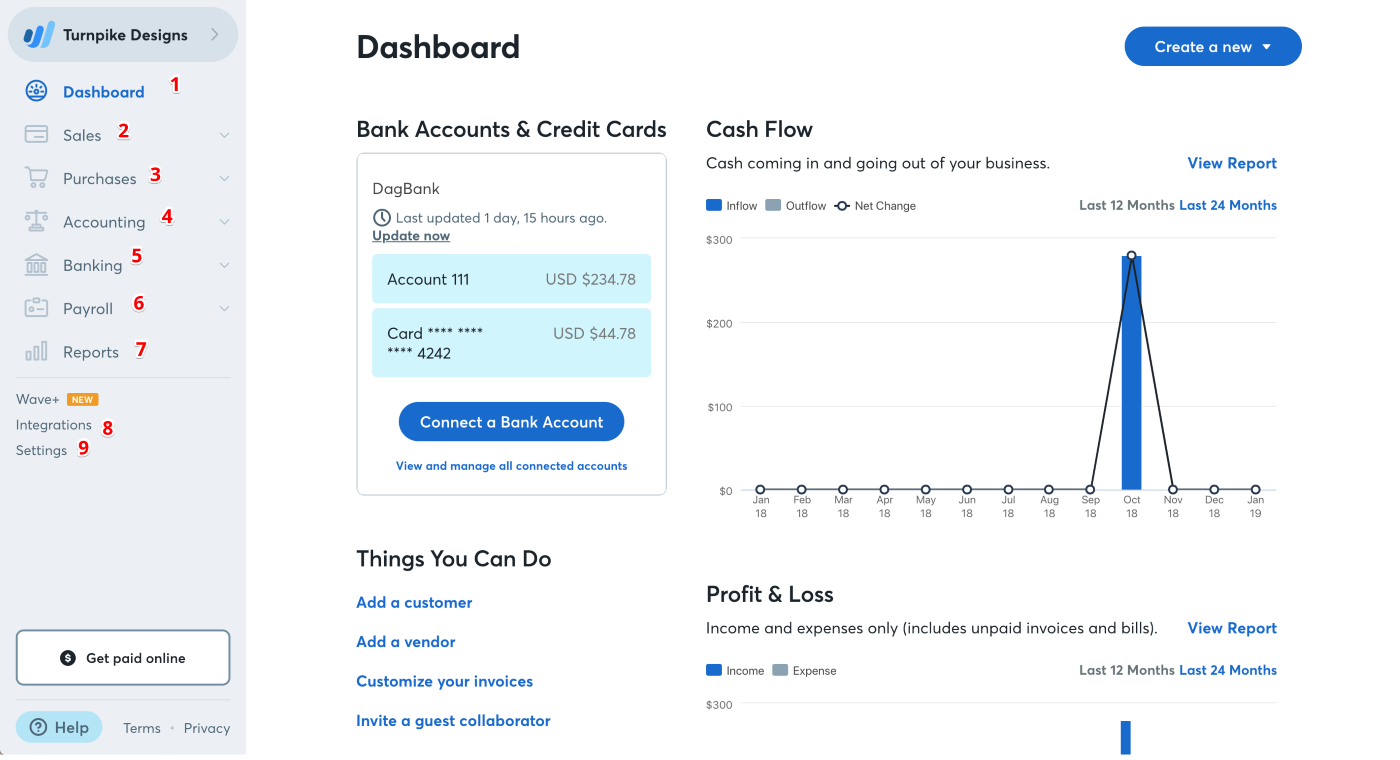

The majority of the bookkeeping you’ll do in Wave will be categorizing your transactions so you can report on them later for budgeting and tax records. All of that is done from the home screen, where you’ll see transaction information plus filters to categorize your entry. Wave pulls this information from your connected financial accounts. For security reasons, Wave has a read-only connection to your accounts: you can’t use Wave to move money into or out of those accounts.

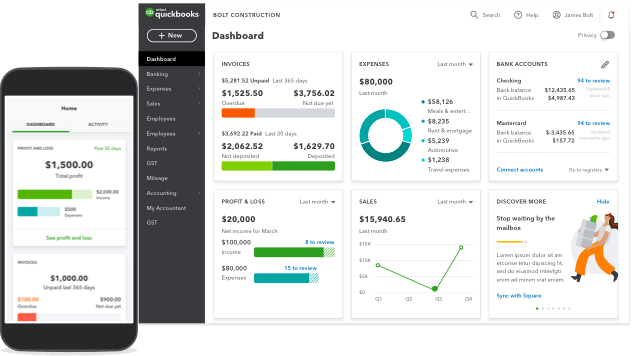

The QuickBooks home dashboard is more focused on reporting the status of your accounts, including giving you views for profit and loss, expenses, and overviews of your account balances. You’ll still need to connect to your accounts, import your transactions, and categorize your accounts like in Wave, but QuickBooks tries to do a lot of this work for you by guessing the type of transaction and learning from previous categorizations.

Invoicing & Payments

“Start a business,” they said; “It’ll be fun,” they said. They forgot to mention that you’d spend a major portion of your time writing up invoices and chasing down payments. Both Wave and QuickBooks help ease this time-suck with invoicing and payments features. Invoicing is totally free for both systems, but they both charge to be your third-party payment processor for credit cards.

There is a difference in the variable rates you’ll pay for Wave vs. QuickBooks credit card processing, but they’re both lower than what you would pay if you contracted directly with the credit card companies, and you have the advantage that the payments move directly into your accounting program. QuickBooks gives you free ACH (bank draft) payments while Wave charges you 1 percent for these.

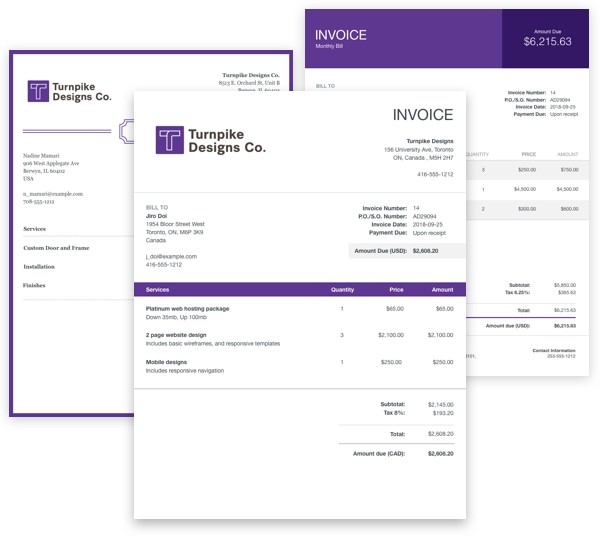

Wave’s invoicing and payments system includes a lot of automatic features for categorizing your outstanding accounts and reminding customers to pay you. Choose from three invoice templates, or customize your own to align with your branding. Wave also offers automatic recurring billing so you can ensure that you get paid by ongoing customers every month/week/quarter. You can even issue full customer statements to show how your relationship has grown.

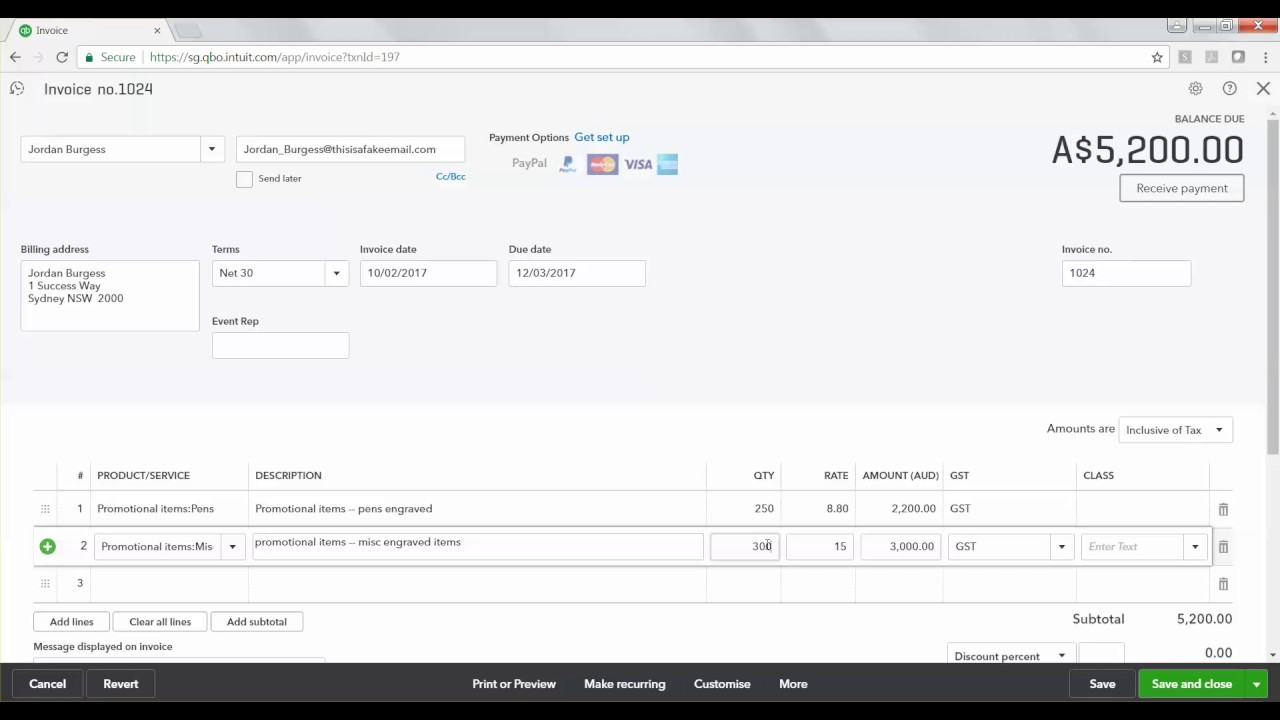

The QuickBooks invoices let customers choose from lots of payment options including ApplePay, Square, and credit cards, and customers can pay directly in the invoice. They also put link tracking on invoices so you automatically get a notification when a customer views or pays the invoice. Once paid, QuickBooks will automatically match the payments to invoices, cutting out a lot of time you would otherwise spend figuring out which invoices are paid and which are outstanding. This smart technology even extends to those who choose to pay incrementally: QuickBooks will match partial payments and show an outstanding balance.

Payroll

As soon as a small business grows to two employees, you’ll need to figure out some sort of payroll system to keep them around. Because payroll is complicated by tax and regulatory issues, it can be a bear to tackle. That’s why most small business accounting software companies will charge an extra fee to manage payroll. Wave and QuickBooks are no exception. All of the features in this section come at an extra fee on top of general accounting and invoicing.

Wave has a near-automatic payroll system with quick approvals, an employee self-service portal for stubs and banking information, direct deposits, and special settings to provide employees with benefits and vacations. Some helpful features that Wave also offers are automatic tax filings for 6 states and seasonal-work-friendly labor pauses at no charge. Wave charges a base monthly fee plus a charge for every active employee.

QuickBooks offers two levels of payroll: Enhanced and Full Service. The Enhanced integration doesn’t seem nearly as smooth as with Wave, as you’ll have to import or manually enter hours from your time tracking software for every pay period. However, tax filing is easy, as QuickBooks will automatically generate your tax forms and you can use eFile and ePay from within the app. QuickBooks also gives you unlimited payroll, which means you can run it as many times a month as you need with no extra cost. If you’ve got more money than time, sign up instead for the Full Service and get QuickBooks to handle the process for you.

[get-pricing category=”CRM” cta=”Get Pricing” width=”200px” url=”quickbooks-reviews”][/get-pricing]

Collaboration

Because the small business owner is likely an expert on their product rather than an expert in accounting, they often have to call in the professionals to oversee the books and ensure compliance with tax laws and regulatory authorities. You’ll find that both Wave and QuickBooks offer the ability to invite collaborators to view your accounts, but with a few differences.

In Wave, you’ll need to add your collaborator to every account you want them to see. This safety feature means you can pick and choose who sees which business or personal accounts. Once added, they can receive notifications for updated records and files you share with them. Collaborators can have view, edit, and send permissions, but don’t worry, collaborators don’t have access to your banking or credit card numbers. That said, collaborators can see the whole set of accounting tools for every account you add them on, so be sure that you’re ok with them having view access.

QuickBooks has a whole special software designed just for accountants to manage multiple client accounts all from a single dashboard. All the small business owner has to do is give them access to an Accountant’s Copy of their ledger. This copy of the business records lets both the client and accountant work on managing the account at the same time. There are restrictions to the Accountant’s Copy to keep data from being duplicated or overwritten. The Accountant’s Copy help documents are extensive, so there’s lots of support for this tool. Also, because QuickBooks is so popular across small business accounting, most accountants with some experience will have worked with the system.

Reporting

Easy to view and understand reporting is important for small business owners who need at-a-glance updates on their financials and don’t have time to pore over ledgers and account sheets to get a full picture of the state of the business.

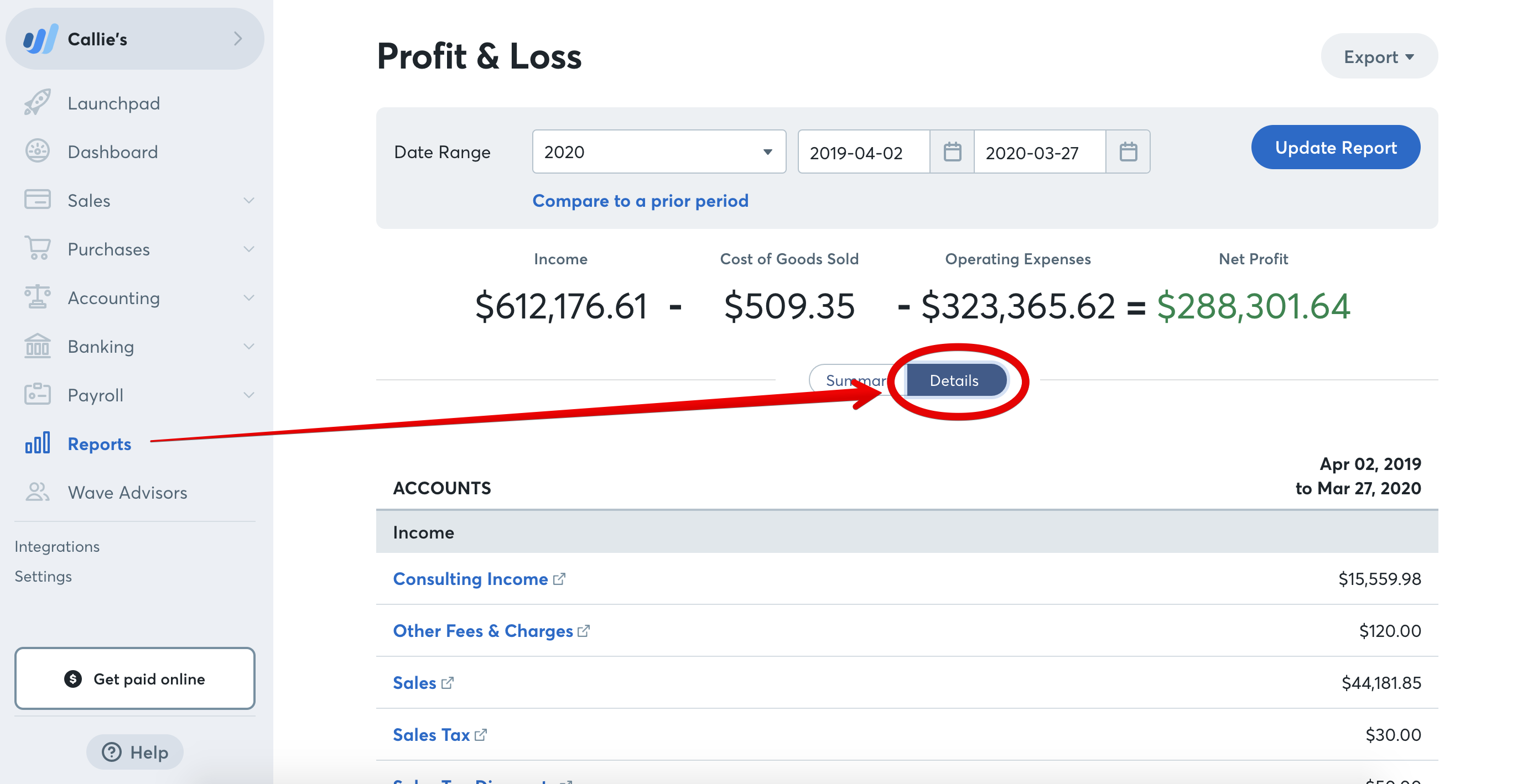

Wave updated their reporting tools in April 2018 to make them more intuitive and house them in an easier-to-use interface. They’ve pulled some of the most-used reports out of your general ledger and made those accessible through the Reporting menu. The Reports page categorizes the views of your account into Get the Big Picture, Stay on Top of Taxes, and Focus on Customers, with helpful report views in each. While an improvement over a general ledger view of your accounts, these reports don’t provide complex data analysis.

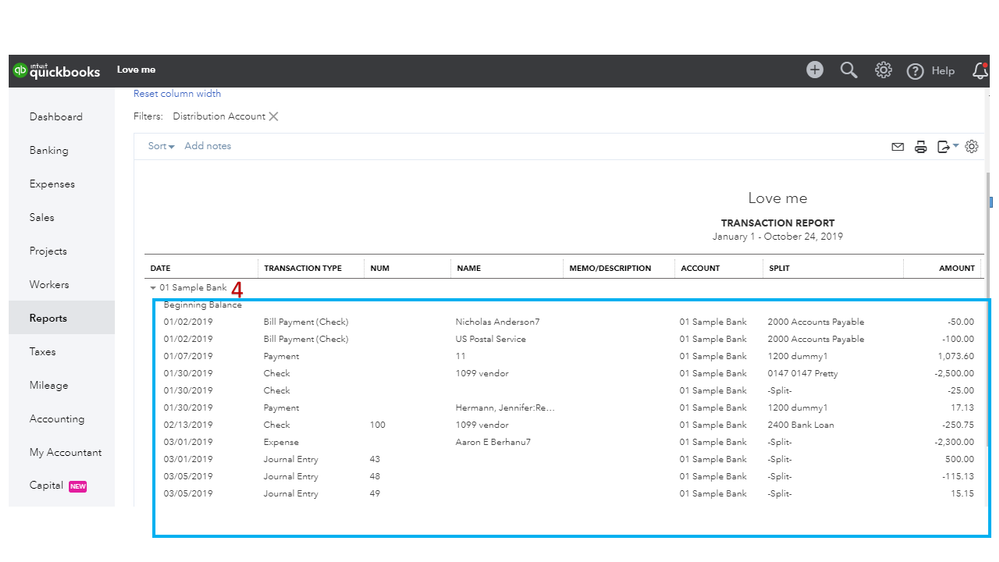

QuickBooks has the upper hand here with in-depth reporting for all plans and levels. There are a lot of snapshot reports that are available with one click, and your dashboard homepage provides simple KPIs and metrics to give a quick view of account health. Look for advanced reporting features like budgets, sales reports, and more, and you can always download a .CSV of your accounts to import to your BI software.

Experience vs. innovation

QuickBooks has a robust history in the world of accounting software, and many companies turn to it for its reliability and functionality. The software doesn’t generally change much outside of patches or scheduled updates, and many small business owners like knowing exactly what they’re going to get. Because of their level of experience, QuickBooks can offer a level of service and expertise that many small businesses need.

However, experience isn’t everything when it comes to small business accounting. Compared to QuickBooks, Wave is a relative newcomer to the accounting software industry, but they have a lot to offer their customers. As a newer company, Wave is more willing to innovate, leading to exciting features like the ability to manage more than one business from a single account. If you feel confident in your accounting abilities, you may like the innovations that a newer software can offer.

Wave vs. QuickBooks: SMB accounting options

The differences for Wave vs. QuickBooks small business accounting software are fairly minimal. Wave provides a great starting place for super-small businesses and freelancers with free accounting and invoicing tools without a lot of complicated bookkeeping features. QuickBooks offers reasonable pricing for small business owners, but the abundance of features they offer that provide flexibility for growing businesses could overwhelm those just starting out.

Wave and QuickBooks aren’t the only small business accounting software choices competing for your business. You’ve come to the right place to compare the best accounting software to fit your needs. Visit our Accounting software category page for accounting software for reviews of the best accounting tool for your small business.