Excel is a powerful tool used by most businesses in some way, shape, or form. It allows you to congregate, track, and manipulate data to serve immediate needs or answer questions. But it was never designed to meet all of your business needs, and it certainly isn’t the best choice for processing or tracking commissions for your sales team.

ALSO READ: CPQ Software: Top 6 Solutions and a Case Study

Processing commissions is already a tedious task, and using Excel only makes it more complicated. Today, there are much better options in commissions-specific software. Let’s discuss the reasons your business should be hesitant to continue using Excel spreadsheets and consider commissions software instead.

Downfalls of Commissions Processing in Excel

1. Error-Prone

First, and most notably, Excel spreadsheets are error-prone. In fact, research shows that 88 percent of Excel spreadsheets contain errors. While Excel has intuitive formulas you can use to calculate commissions, that doesn’t stop humans from making errors through manual data entry, accidental deletion, forgetting to include certain cells in formulas, forgetting to save, etc.

When companies move from Excel Spreadsheets to commission-based software, they greatly reduce errors. On top of all of the potential errors we’ve talked about, inconsistency also occurs for businesses when they have multiple versions of a spreadsheet. One survey found that 44 percent of businesses have issues with multiple versions of spreadsheets.

With commissions-specific software, the data needed to run the calculations are set up once, and you generally don’t have to update them again. Of course, you can make edits to percentages or amounts paid, but the amount of errors decreases dramatically when data can’t be easily or accidentally changed.

2. Time-Consuming

In this same survey, respondents said they spend 12 hours every month “consolidating, modifying and correcting the spreadsheets they collaborate on with others and reuse frequently.” And the hours only increase the more reps you have to pay. It’s a waste of company time to fumble around with multiple spreadsheet versions and entries every time you pay out.

What’s worse, errors become acceptable. Employees realize there are errors but don’t want to spend the time to find them (assuming they’re small). It never looks good to have an agent or rep dispute what you’re paying them when they find an error.

Companies who switch to commissions-specific software save hours of time going from a more manual process to an automated one. Plus, when the employees who process commissions spend less time reviewing spreadsheets and searching for errors, they can focus on other important tasks for your business.

3. Restricted/Inaccurate Analysis

Performance analysis is essential for any kind of business. After all, how can you make improvements when you can’t see where you’ve been and where you’re headed? Analyzation within Excel spreadsheets can prove difficult and, again, time-consuming. You can manipulate the data and create graphs and charts within a spreadsheet, but these all require very manual processes.

The term “GIGO” (garbage in, garbage out) also applies here. Beyond being manual and time-consuming, the errors we’ve discussed that can happen within a spreadsheet leads businesses to make assumptions or decisions based on inaccurate data. This isn’t good for any company hoping to improve their operations.

Further, Techwalla explains that Excel spreadsheets should really only be used for short-term analysis — not long-term. When it comes to commissions data, you want to be able to go back one, three, even five years and look at trends. Simply put: Excel isn’t the way you can successfully do this.

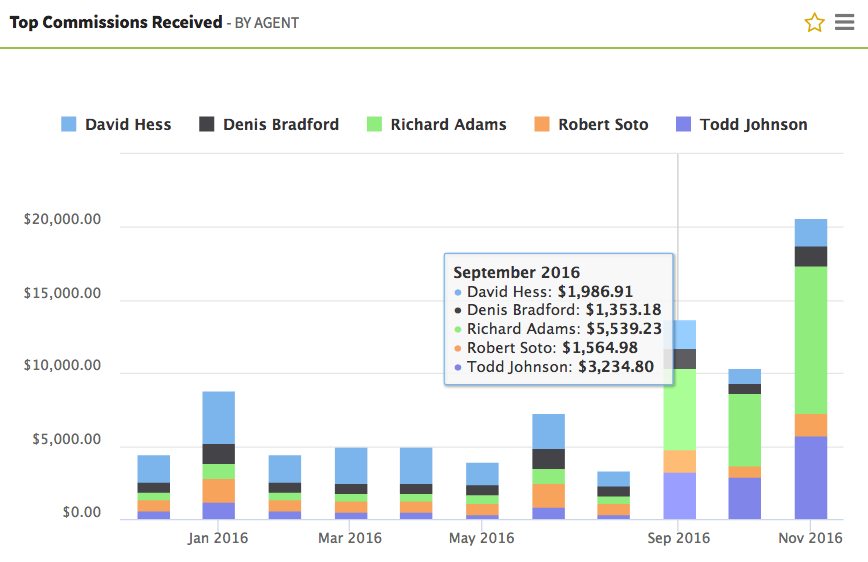

With commissions-specific software, analysis is more straightforward. Sometimes, the software even creates real-time graphs for you to monitor. At the very least, you’ll be able to run reports from the system based on the specific criteria that you want to compare. You can use this data to guide your business in the right direction based on accurate conclusions.

The following image is an example of a real-time graph that shows commissions received per insurance agent within AgencyBloc. With this data, the business can identify their top producers and better understand which salespeople might need more assistance or guidance. This is only one example of the data you can isolate and analyze with commissions-specific software.

Searching for Commissions-Specific Software

When searching for a commissions-specific software tool, the choices can be a bit overwhelming. Be sure to consider industry-specific options, where they exist, as these make it easier to build workflows that match the needs of your team and meet regulatory standards. Insurance agencies or retail businesses, for example, might want to consider an industry-specific solution.

You should also understand that many CRM platforms come with built-in commissions tracking features. This could be a great option for businesses wanting to keep all of their data in the same system.

Bottom line: if you’re still using Excel spreadsheets to process and track the commissions side of your business, you’re probably taking too much time processing, your spreadsheets probably contain errors, and you aren’t learning and growing from data analysis like you should be. Time to make a change? Probably so.

Kelsey Rosauer is the marketing brand specialist at AgencyBloc. Kelsey creates and maintains educational content for insurance agencies to make better business decisions, including technology use. AgencyBloc is an agency management system that helps life and health insurance agencies grow their business with an industry-specific CRM, commissions processing, and integrated business and marketing automation.